Inside Pollen's Software Engineering Salaries

What was the compensation philosophy of the events tech startup, and how much were devs, EMs and PMs paid?

👋 Hi, this is Gergely with a bonus, free issue of the Pragmatic Engineer Newsletter. We cover one and a half out of eight topics in today’s subscriber-only issue, Inside Pollen's Transparent Compensation Data. If you’re not yet a subscriber, you also missed this week’s deep-dive on Becoming a Fractional CTO. Subscribe to get this newsletter every week 👇

Pollen was an events tech startup founded in 2015, which raised more than $200M in funding and employed about 600 people by 2022. It defied gravity by appearing to thrive at the same time as the Covid-19 pandemic shut down swathes of the events industry, worldwide. But after a series of layoffs, the company ran out of money and entered administration last August. Today, employees are still owed months’ worth of wages and pension contributions. I covered the collapse of the company at the time in the article Inside Pollen’s collapse: “$200M raised” but staff unpaid - exclusive. It remains my most in-depth investigative article.

During its existence, Pollen did something very interesting: implementing pay transparency. Every employee could examine a PDF with compensation details for every role at the company.

In this week’s The Scoop, I analyzed this information and dissected it, going well beyond the raw data. Here are a few details from the data points, focusing on software engineering compensation.

Pollen’s compensation philosophy

When it comes to compensation philosophies across tech, I have been categorizing companies into three tiers within a model I call the Trimodal nature of software engineering compensation:

Tier 1: hyperlocal compensation. Companies benchmark against local competitors. These companies typically pay a base salary. Some might also offer a cash bonus.

Tier 2: competing against all local companies and positioning closer to the top of the local market. These companies typically pay a base salary and tend to offer either an equity component or cash bonuses.

Tier 3: competing against all regional/global companies. Much of Big Tech and some well-funded startups belong in this tier. These companies tend to offer a base salary, generous equity and generous cash bonuses.

Overall, Pollen offered a pretty good base salary and a relatively small equity component for most employees. I would categorize Pollen as having been towards the bottom of Tier 2.

In what was less usual, Pollen did not pay cash bonuses to anyone. Also, the equity part was unusual at Pollen. Despite this, the company managed to hire strong talent on the engineering side, and its alumni now work at the likes of Cloudflare, Amazon, Bloomberg, Typeform, among others. I asked tech employees why they chose to work at the company, and answers came down to a mix of the support for remote, attracted to a culture of transparency - like with the equal pay report -, the diversity of the team and the career opportunities that came with a seemingly high-growth startup.

Equity was unusually distributed and seemingly little valued. Although Pollen issued equity for all employees, it did not explain the value of its equity. I’ve talked with lots of former Pollen employees and even engineering managers had no real understanding of how their equity worked, and no one had a sense of its value beyond the number of stock units issued.

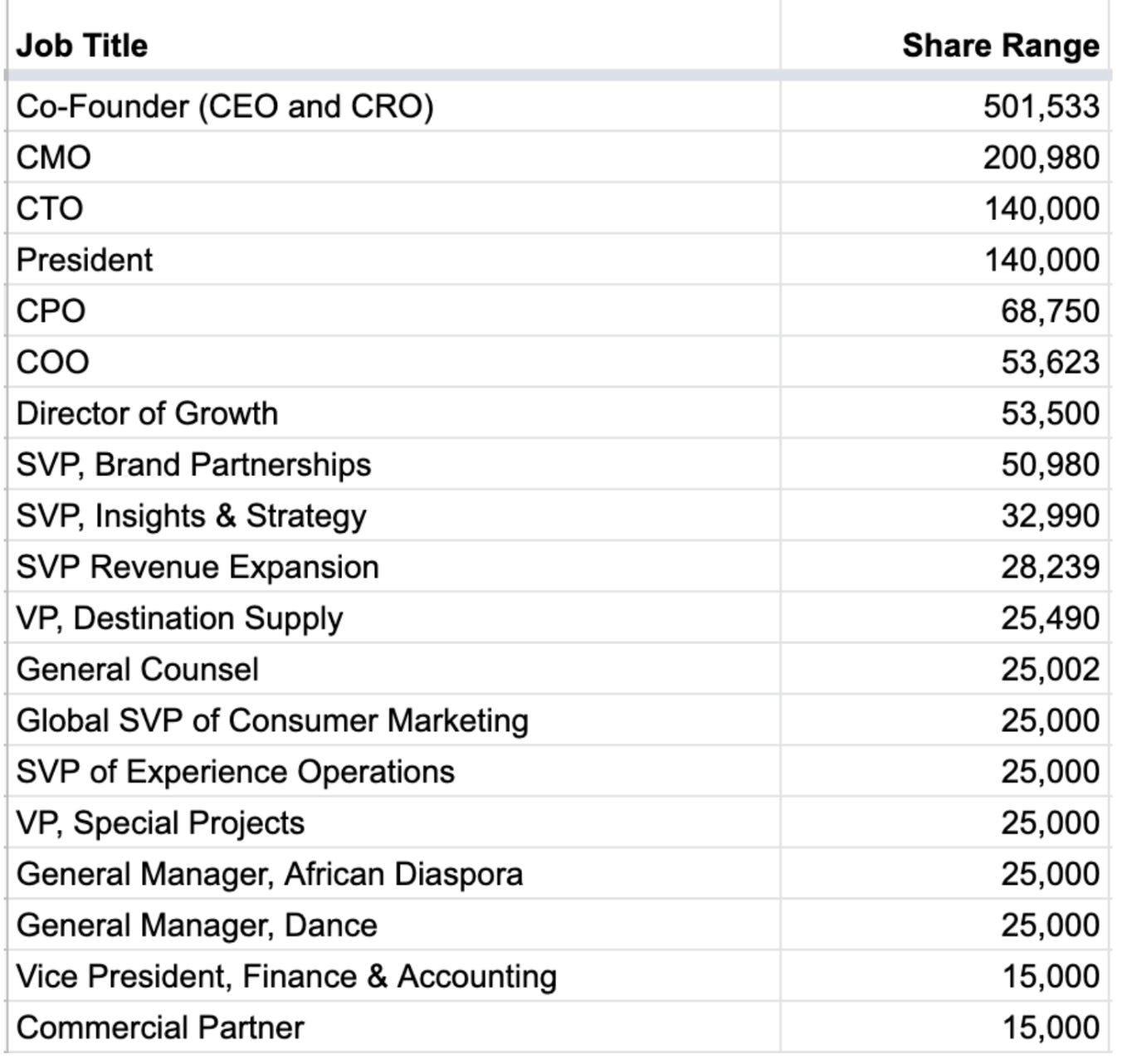

75% of employees at the company received between 500 and 1,500 equity units that vested over 4 years, with no refresher issued for most. The top 25% of employees received on average about 8,000 units. As per the report, 9 roles within the company received more than 50,000 equity units:

Employees had no idea what the value of a share unit was, as the company never shared this information.

In my analysis, I attempted to put a price tag on the equity units by taking the outstanding number of shares of the company – 21 million – and using hypothetical target valuations. At its peak, Pollen I estimate Pollen was valued at around $300M by investors, which would have meant a $14 share price.

In the end, the equity for all employees ended up as zero, and all the figures for valuations are hypothetical.

Still, I find it confusing that the company issued equity, but didn’t even attempt to convey its value to the vast majority of employees. I find this especially strange given the company brought in several venture capital (VC) firms, the best known being Northzone, a VC which backed Spotify, Klarna and Personio in the past. Employees at those companies have known the value of their equity since the early stages.

Software engineering compensation numbers

I collected software engineering-related compensation numbers, grouping them for easier browsing.

Software engineering:

Engineering management and product:

The vast majority of the tech team was based in the UK and Poland, with a few roles in Europe and the US.

My take is that Pollen generally paid well for tech, but did not target the very top of their respective markets. I would suggest that in London, its rates were around the 75th percentile. I suspect the company was able to attract good tech talent despite not overpaying in markets like London or Warsaw, thanks to supporting remote working, possessing a good brand, and being focused on building a diverse team – at which it did a good job.

Full subscribers have access to all tech compensation numbers, including for data science, data engineering design, and leadership roles.

This article covered one and a half out of eight topics from the Inside Pollen's Transparent Compensation Data article, available for full subscribers. The complete article additionally covers:

The pay transparency report. An overview of the report and the cadence at which it was published.

Regional pay differences. Pollen employed a large number of people in the UK, Poland, the US and from across the EU, also hiring from Sweden and Mexico. How was pay calibrated across these regions?

Tech compensation numbers. How much were data scientists, data engineers, designers, leadership and other tech functions paid?

Highest and lowest-paid roles. Which roles did the company reward most and which the least?

Budgets by organization. How did funding for the tech organization compare to funding of other organizations such as Marketing, Operations and Revenue?

Inspiration to take from this pay transparency report and numbers. How can you use this data in budgeting, and what are the caveats to be aware of?

Reports. Access to three detailed reports in Google sheets, where you can slice and dice the data derived from 430 data points.

Full subscribers have access to a cleaned and browsable version of the extended data set, which can be helpful in diving in to get further details, and in refining your compensation philosophy. As a note, this data set is even more expansive and detailed than the Inside Microsoft’s compensation numbers which we covered last August.