The Pulse: Section 174 is reversed! Mostly, that is

Finally, relief: tax regulation hurting the US tech industry is striked off for good - for the most part, that is.

Hi, this is Gergely with a bonus, free issue of the Pragmatic Engineer Newsletter. In every issue, I cover Big Tech and startups through the lens of senior engineers and engineering leaders. Today, we get into one out of four topics from last week’s The Pulse issue, which full subscribers received seven days ago. If you’ve been forwarded this email, you can subscribe here.

In this issue, we cover a change on Section 174 — which could have contributed to fewer software engineers hired in the US 2023-2025. However, this was likely not the main cause of the decline. I did more analysis on the actual root cases: the end of zero interest rates in these deepdives:

The end of 0% interest rates (ZIRP): what it means for tech startups and the industry

The end of ZIRP: what it means for software engineering practices

Since early 2024, a tax change in the US named “Section 174” has been plaguing tech companies in the country. It was introduced during the first Trump administration in 2017, came into effect in 2022, and impacted businesses from the tax year of 2023. The next year, many tech companies discovered just how bad S174 is.

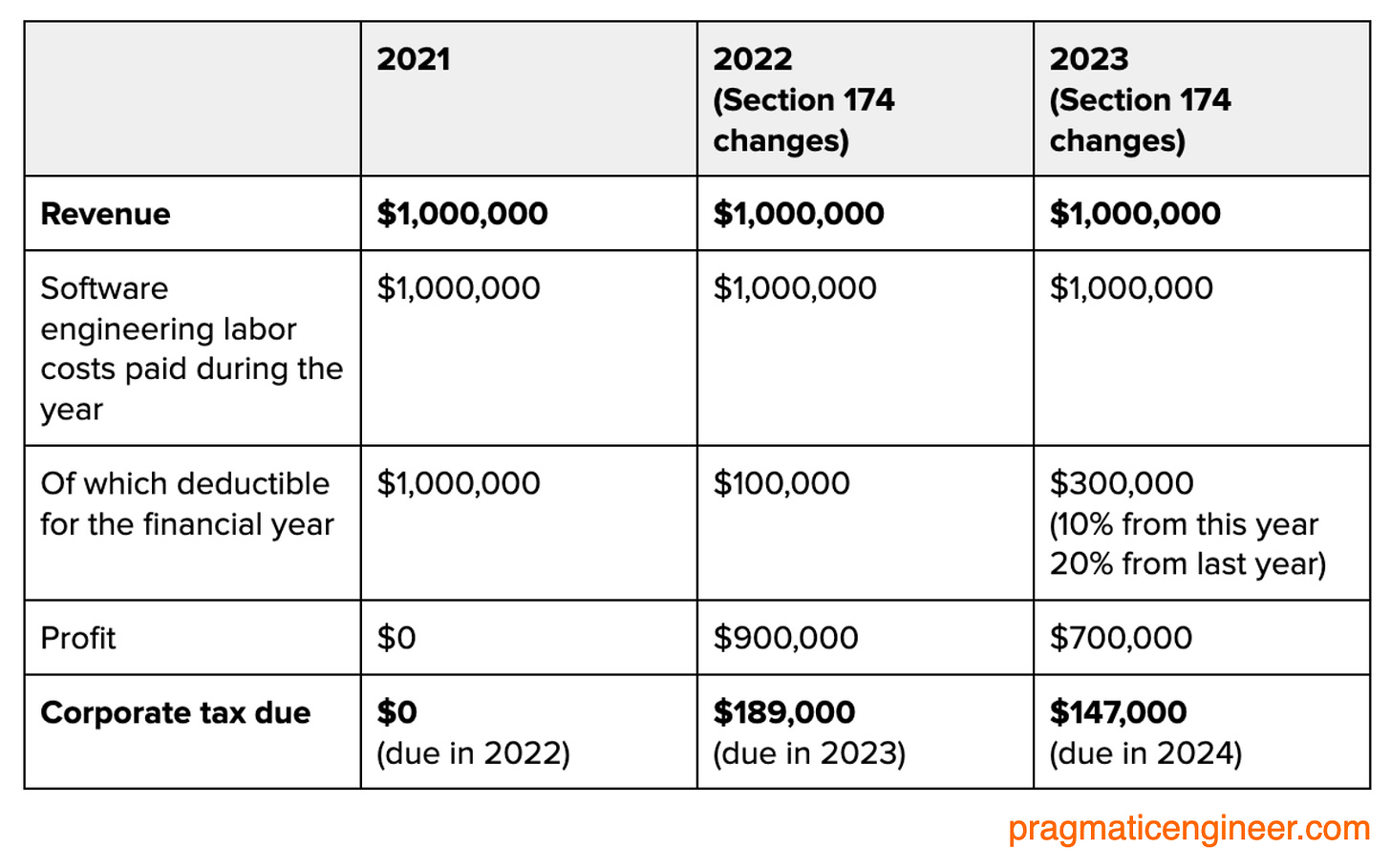

In short, salaries paid to software engineers can no longer be deducted as a cost, like all other employee wages are. Instead, they must be amortized over 5 years for developers in the US, and for 15 years (for developers outside the US.) This treats software development similar to physical assets like servers. The big difference is that software is not an asset that necessarily has re-sale value.

We published a deepdive on why this regulation was likely to result in more developers being fired by tech companies, and fewer being hired. The regulation especially hurt small businesses, bootstrapped companies, and those making a small loss or profit. In short, a small, bootstrapped company spending $1M in developer costs that made zero profits would have suddenly owed $189K in corporate tax thanks to this tax change:

The regulation was designed to increase tax revenue from tech companies and entered the tax code, applying to all software developers, except those in the oil and gas sectors! Due to Section 174, the US became the only country in the world where developer salaries cannot be expensed in the same tax year. Read more in our deepdive on S174.

But things have changed. Some great news is that part of S174 is struck off , fully for US employees. Buried deep inside Trump’s “Big, Beautiful Bill” is a provision that allows companies to keep deducting expenses related to software development in the same tax year. Basically, developer salaries can be deducted just like before 2023. Companies have the choice to amortize salaries if they want. In the original draft, this was planned to be a temporary relief until 2030. But in the final bill it was removed permanently.

Additional good news is that costs can be expensed retroactively. Also added in the bill is how companies can do two years of “catch-up:” businesses can re-file tax returns using the old expensing rules 2022-2024. Basically, companies hurt by having to pay more tax in 2022 to 2024 can go back and claim back the surplus they paid.

This is an immediate relief to all US companies, but it’s not all good.

The remaining thing that stings for companies is how foreign devs still need to be amortized for 15 years. US companies making foreign software development-related expenditures like hiring staff, or paying for contracts abroad, are still mandated to be expensed over 15 years. This period is very long, and will incentivize US companies to consider cutting developers abroad, or recruiting less from outside the US.

US tech companies have done plenty of hiring abroad, especially in Europe and India. The regulation makes it clear that anything considered research and experimental (R&E) that’s done outside the US needs to be expensed over 15 years.

I expect US companies to hire more in the US, and less outside of it. The updated Section 174 very clearly incentivises doing so. If you’re in the US: this is great news! If you’re outside, prepare for US-based companies to be incentivized to make cuts abroad, and to hire less outside of the US.

Check out last week’s The Pulse and this week’s The Pulse for more, timely analysis on the tech industry.