What Big Tech layoffs suggest for the industry

Microsoft, Amazon and Salesforce have announced large layoffs in January. What will these events mean for the rest of the industry?

👋 Hi, this is Gergely with a bonus, free issue of the Pragmatic Engineer Newsletter. We cover one out of five topics in today’s subscriber-only The Scoop issue. Subscribe to get the full issues, twice a week 👇

Microsoft announced eliminating 10,000 positions on Wednesday - and I analyzed why the company decided to make this move despite earning record profits in 2022, in this week’s The Scoop. The layoffs at Microsoft suggest that in 2023, the tech industry may stall growth-wise. By cutting 5% of staff, Microsoft reduces its headcount from 221,000 to around 211,000. We can expect that by the middle of this year, the company’s headcount will increase, but only modestly, and still be below the 221,000 figure it was at last July.

However, Microsoft’s business is incredibly diversified, to the point that it can be pretty representative of the B2B tech industry, minus advertising. Taking the visualization from Visual Capitalist, here’s the breakdown of the company’s revenue sources:

Microsoft’s business is much more diversified than any of its competitors. The largest revenue source is Cloud at 31%, and there are 6 revenue sources which each account for 5% or more of company revenue: Cloud, Office, Windows, Gaming, LinkedIn and Ads.

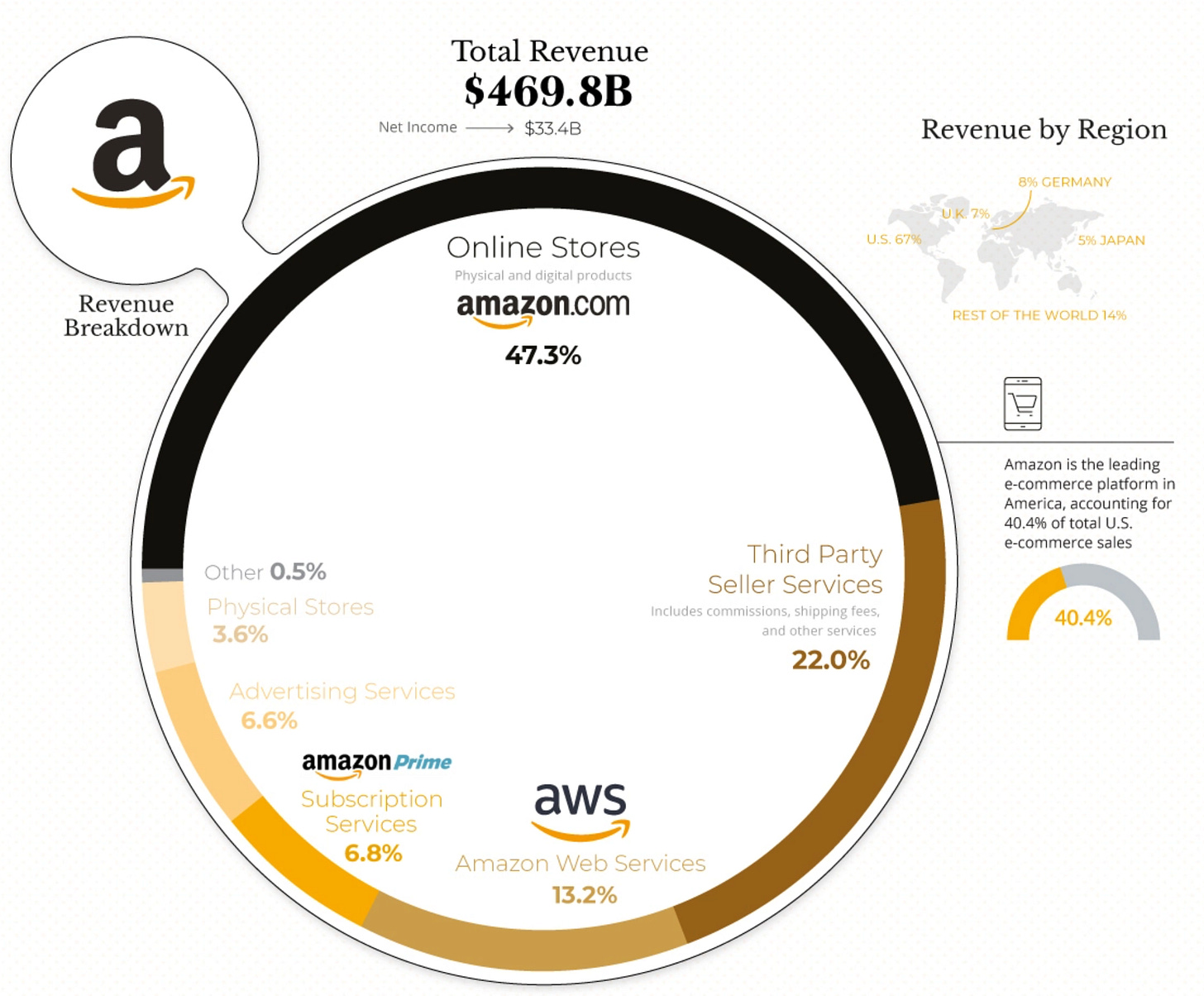

Amazon and Apple are the only two rivals with comparable diversification. Amazon has 5 segments each accounting for 5% or more of revenue: Online Stores, Third-party seller services, AWS, Prime, Ads:

Meanwhile, Apple also has 5 segments which each account for more than 5% of revenue: iPhone, Services, Wearables, Mac, iPad:

Google, on the other hand, makes 81% from Ads, While for Meta, it’s 97%. Meta is incredibly reliant on ads, and this reliance is the reason for the company’s historic growth challenge.

Microsoft’s layoffs worry me precisely because the company has a very good track record of predicting how the business will grow or shrink. As for Amazon, while I’ve not conducted the same level of analysis, the e-commerce giant is not dependent on ad revenue in the same way Microsoft isn’t, and its business is similarly diversified. Both Microsoft and Amazon have been pragmatic in growing their businesses and are nimble to react when the external environment shifts.

As I wrote in July 2022, in The Scoop #19: The start of a tech winter?

“But what is making Big Tech react much faster than other companies? I’ll suggest this is because they are more nimble in how they both gather and analyze data, and in how they operate, compared to some more traditional companies.

This means Big Tech predicts a slowdown in business, based on data they have, and is implementing a slowdown immediately. Traditional companies either don’t detect changes in the market with such sensitivity, or they might have learned to take a longer-term outlook, and not worry about changing direction.

Don’t forget, most of these traditional companies have been around longer than Big Tech firms, and the fact that they are not as “jumpy” in reacting quickly is a feature for them, not a bug.”

This was back when Big Tech was “merely” freezing hiring; Microsoft, Google, Meta all froze at that time, and Apple was rumored to be reducing its pace of hiring. Only Amazon hired as normal, back then:

Since then, the situation has changed. Here is how things look at time of publishing:

The situation is especially grim, when looking at how things were just year ago:

It’s certain we’ll see a correction of 2021-22’s hiring frenzy and it’s a given that Big Tech will hire much less this year than in 2022, while the question remains whether other large tech companies will follow suit and announce layoffs in the coming months.

This was one out of the five topics covered in this week’s The Scoop. A lot of what I share in The Scoop is exclusive to this publication, meaning it’s not been covered in any other media outlet before and you’re the first to read about it.

The full The Scoop edition additionally covers:

Microsoft’s layoffs. The tech giant announced eliminating 10,000 positions on Wednesday, which is about 5% of staff. The company made a $72B profit in 2022 - which is more than the revenue it had in 2011. So why does Microsoft need to do layoffs? Analysis.

Layoffs at Goldman Sachs. The investment bank cut 6% of staff, and is the first major non-tech company to do deeper cuts. Is this cause for worry? Analysis.

Layoffs and hiring freezes: it’ll get worse before it gets better. Amazon, Salesforce and a bunch of other companies made cuts in January. I analyze why we’re likely to see a spike on layoffs and hiring freezes in the coming period. Analysis.

Will we see a focus on sustainable growth for startups? Profitable, has lots of money in the bank, and growing the team deliberately slower than revenue increases, not digging into money raised. This kind of approach was not what investors expected from fast-growth startups, yet it’s the approach Linear is taking. Will we see more companies follow? Exclusive details.