Cloud Development Environment Vendors

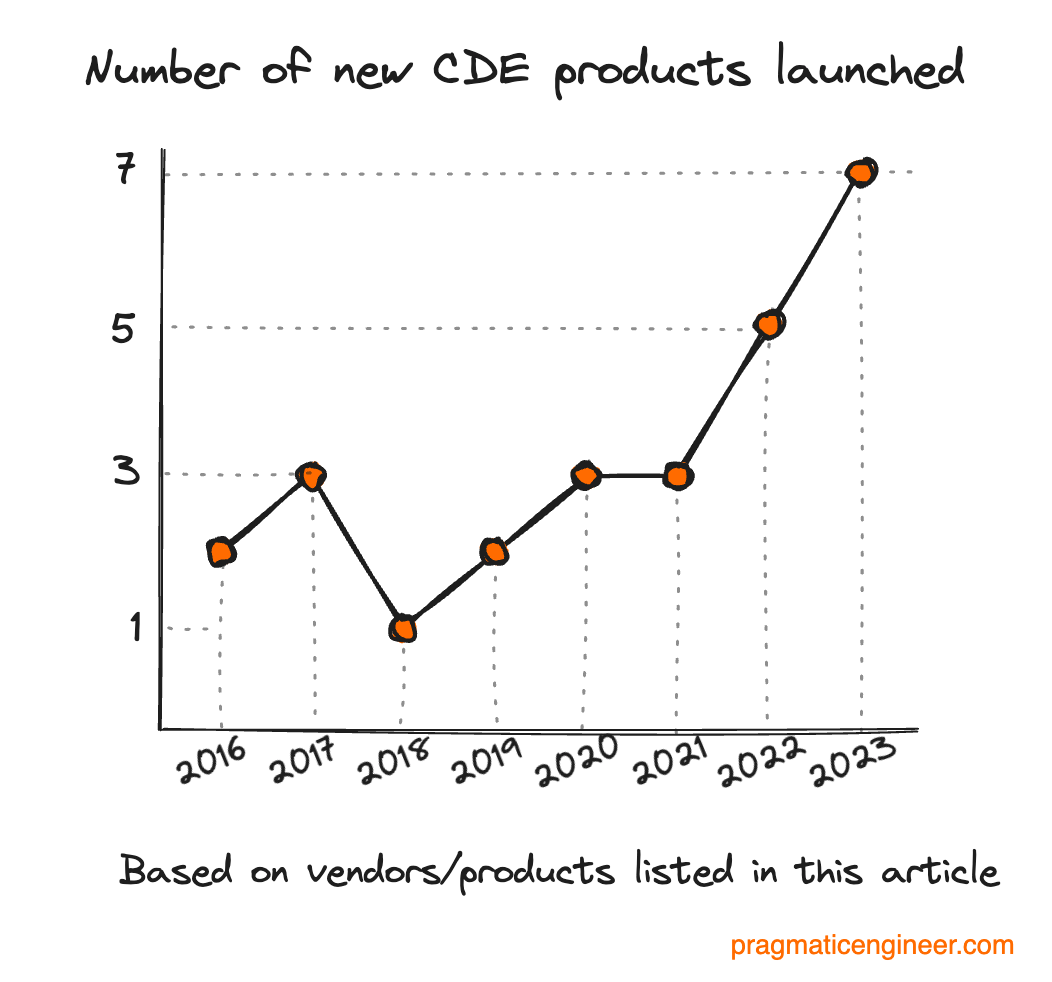

Remote development is an increasingly hot trend across the industry, with more vendors launching every year. An overview of 28 cloud development startups and open source solutions.

Today’s article happens to go head-on-head with Gartner Research – even if accidentally. Gartner mentioned cloud development environments for the first time, in their 2023 Gartner Hype Cycle this August – two months after we analyzed the CDE trend in The Pragmatic Engineer. A Gartner subscription unlocks details about 11 CDE vendors in their report. In contrast, this article covers 23 vendor products plus 5 more open source solutions. From readers who had access to Gartner’s research (that costs around $50K per year or more to access), I heard that the below report is more ‘pragmatic’ and helpful than the Gartner put together.

This article mentions several vendors in the CDE space. I have no affiliation with any, and am not paid to mention them. For details on how I stay independent, see my ethics statement. If you’d like to stay up-to-date with the tech industry, with analysis that is oftentimes more thorough than what Gartner offers, do subscribe:

This article was originally paid, with the paywall removed in 2025.

Cloud development environments (CDEs) are gaining traction. We previously covered how large and medium-sized companies are building their own solutions, and looked into why this trend started accelerating around 2021-2022. What we’ve yet to do is look into the vendor landscape, which is a gap we fill in this issue.

In today’s article, we cover:

CDE vendors: a timeline. An overview of solutions launched in the past decade.

CDE startups and open-source solutions. A summary of vendors without Big Tech backing.

Gitpod. The company has cleverly positioned itself as a leader in CDEs, and keeps evolving its offering.

Stackblitz. A unique approach, and the only vendor not using virtual machines (VMs) in the cloud.

DevZero. The influence of Uber’s DevPods, and how the company is aiming beyond being “just” a CDE vendor.

Crafting. Taking inspiration from the developer experience at Google and Facebook, and building it, targeting tech companies.

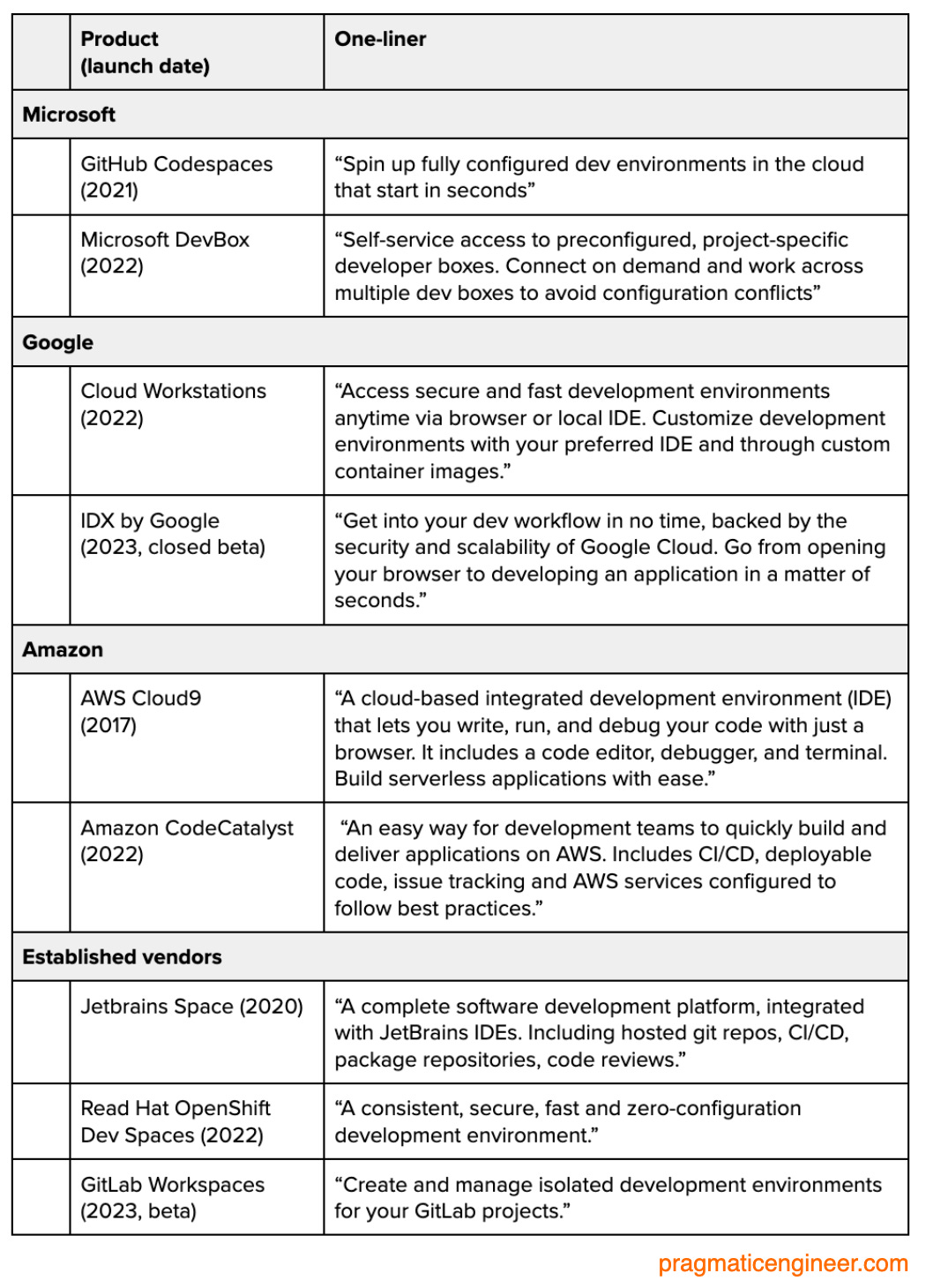

Big Tech and established companies. Amazon, Google, Microsoft, Red Hat, GitLab and Jetbrains, have all launched offerings in recent years. An overview of these.

1. CDE vendors: a timeline

With more than 20 players in this space, let’s begin with a timeline of when the products launched. The segment really took off around 2018, although Cloud9 – which AWS acquired in 2017 – was founded in 2010.

2. CDE startups and open-source solutions

How do startups in the CDE space measure up to each other? Unfortunately, any comparison is apples-to-oranges because each vendor offers different things. Some like Replit offer a relatively small, dedicated environment that’s geared for personal usage. Others like DevZero offer managed environments, where customers provide the infra. And then there are vendors like Gitpod or Crafting which offer both managed and hosted solutions.

Below is an (admittedly imperfect) table with details for each solution, to provide a sense of what’s available, with rough pricing that’s accurate at time of publication.

Let’s dive into the details:

Replit is probably the most popular collaborative coding environment for personal use. Its name is a play on REPL: Read-Eval-Print Loop, which is a computer environment in which inputs are read, evaluated, and returned to the user.

In February, the company celebrated 20M Replit developers who have created more than 240M Repls. It’s very popular with students and for personal use, but the company is now opening up to team usage as well, a “Teams Pro” tier for $15/user/month. This tier offers 2GB memory, 2 CPUs and 10GB of storage.

While Replit has a business tier with Teams Pro, my sense is that the company is not looking to target large companies, and is focusing on personal usage: at least for now. At the same time, I’ve talked with several CTOs and founders who pay for a personal Replit space to quickly prototype ideas.

Replit is the only vendor offering both native iOS and Android applications for development.

Codesandbox started out as a web IDE in around 2018. In 2020, the company said more than 4 million developers used its web-based solution, monthly.

Recently, Codesandbox has expanded from a web IDE, into providing instant developer environments – connected to via Visual Studio Code – which resume within 1 second. Codesandbox is headquartered in Amsterdam, and I recently met CEO and founder, Ives van Hoorne. I plan to share more details about Ives’ journey as a first-time founder in the newsletter, in a later issue.

Codesandbox is the only other company offering a native app to develop, by shipping a native iOS app but no Android version.

Coder is one of the few vendors that offers only a self-hosted CDE platform. The platform’s Open Source product is free to use, which is ideal for personal use. The company offers an Enterprise tier that adds security, governance and tools, as well as features like user access and auditing; such as disabling SSH or isolated runners.

Coder customers are responsible for provisioning the virtual machines on a public cloud or in their private data centers, and run the open-source version or enterprise version on top of that infrastructure.

Given that infrastructure costs are a big part of CDEs, I find Coder’s approach to be smart. Large companies which have negotiated bulk discounts for public cloud virtual machines are more likely to want to run self-hosted CDE solutions, and Coder offers exactly this.

Codeanywhere is one of the earliest cloud IDEs, founded in 2013. The company promises to spin up development environments in seconds. It has raised relatively little funding – $600K in seed funding in 2013 – and says developers at places like Adobe, Oracle, eBay and PayPal use its product. The solution feels like it targets individual developers and smaller teams.

Daytona was founded in 2023, and its founders are the cofounders of Codeanywhere. The founders have said that Daytona is a completely new solution, and much more aimed at the B2B market. Daytona currently supports the Visual Studio Code Devcontainer standard, with plans to add support for Devfile and Nix.

I asked cofounder and CEO Ivan Burazin: why start a brand new company? Why not expand Codeanywhere? He responded:

“Codeanywhere is more like Replit: as in ‘here is your web IDE, your runtime and hosting all packaged into one’. Daytona, on the other hand is much more like an orchestration tool: it fits the developers’ workflow. The only common thing between Codeanywhere and Daytona is that both have a cloud IDE component.”

Cloudomation is an interesting vendor, as it almost exclusively targets Germany, Austria and Switzerland. The company launched its DevStack product just a month ago, and I reached out to CEO and cofounder Margot Mückstein for details on the vision and pricing. Here’s what she shared:

“Our pricing model is based on hours of CDE runtime. We currently offer 4 packages:

1,000 hours: €800/ month

4,000 hours: €2,680/month

15,000 hours: €9,700/month

Plus an option for a custom enterprise package.

The above pricing is for self-hosted, i.e. license and support, and includes both the DevStack platform as well as our Engine automation platform, which is used to automate the deployment of CDEs.”

I asked Margot why their website is, by default, German, when CDEs feel like a global solution. Margot shared an interesting insight about the German-speaking market:

“We previously had our website and all our marketing in English by default and tried to target a larger market, but found that it is very difficult to get noticed in an international context, and that particularly German companies prefer German content and German-speaking vendors.”

It seems Cloudomation has cleverly identified a gap in the market for a German-speaking CDE vendor and is aiming to fill it quickly.

Hocus was started in November, founded by former Facebook engineer intern Hugo Dutka and former blockchain developer Grzegorz Uriasz. Hugo told me that they are still in the building phase, and currently have an alpha product in the works. It’s the product that feels is in the earliest stages of readiness, from all of the above.

Strong Network approaches CDEs from the cybersecurity and compliance perspective. The company was founded in Switzerland in 2020 and both its cofounders formerly worked at Snap; its CEO was the director of cybersecurity at the social media company.

A selling point which Strong Network states on its landing page is that its product can onboard external developers, securely. But this is nothing special as it derives from using containers for a secure coding environment, which every CDE does. However, Strong Network also offers features like realtime security logs that lean into security. The company has leaned into collecting awards, and boasts the most startup awards on its landing page of all the companies.

Open source solutions

There’s a surprising amount of open source activity in the space, with robust solutions to help run Visual Studio Code on a server, or implement GitHub Codespaces-like functionality:

Code Server by Coder (2020). “Run VS Code on any machine, anywhere, and access it in the browser.”

OpenVSCode Server by Gitpod (2021). “A version of VS Code that runs a server on a remote machine and allows access through a modern web browser.” The same approach as Gitpod.

Devpod by Loft Labs (2023). Devpod is “Codespaces, but open source,” and based on the Visual Studio Code Dev Containers. Context about the company creating Devpod: Loft Labs raised $4.6M in seed funding in 2021, and claims 100+ customers, including Ericsson, Elsevier and GoFundMe. Loft Labs’ mission is to provide everything which platform teams need to build on Kubernetes, and Devpod is an example of a solution that also runs on Kubernetes.

3. Gitpod’s clever positioning within the CDE industry

Gitpod was launched in 2018 as a product, and in 2020 as a company. The firm feels like it might have the most momentum in the CDE space – at least right now. The company claims to be trusted by more than 1M developers, listing customers like Dynatrace, Quizlet or Factorial. Within Amazon, teams like the Powertools team suggests GitPod as a way for external contributors to spin up a pre-configured cloud environmens.

Developer tools like CDEs can be tricky to sell, as most companies are cutting down on vendor spend, and a CDE solution tends to be in a pricier investment category. In The Pulse #56, we cover advice on how to do so, including suggesting quantifying the product’s value. Gitpod is a vendor that quantifies its offering straight away on the landing page, claiming:

Less than 10 minutes to onboard developers

40% fewer bugs across the development lifecycle

5 hours saved per developer, per week

45% increase in developer satisfaction (NPS)

The company supports these claims with specific customer case studies, making it very clear that CDEs offer benefits in faster onboarding, and reducing the time developers spend waiting on machines. This is a clever approach that other vendors would be smart to follow: it makes the business case for investing in a CDE as a developer or manager.

Dedicated CDEs are in demand, according to Gitpod. It started out as a cloud-only offering called “Gitpod Cloud.” In December 2022, the company introduced its “Gitpod Dedicated” plan where customers bring their own infrastructure, and Gitpod provisions VMs within that infra. I asked Gitpod CEO Johannes Landgraf how the Decicated plan is performing. He said:

“Gitpod Cloud powers our self-serve business with more than 1M sign-ups. This offering targets small and medium sized businesses, and startups, open-source developers, individuals, and students. Since we switched to pay-as-you-go pricing [billing by the hour], we see very healthy two-figure month over month revenue growth rates [over 10% month-over-month growth rate] for that part of the business. Customers on Gitpod Cloud include companies such as Factorial, Shares, A-Lign and Plextrac.

Gitpod Dedicated is our enterprise and mid-market offering and has been a massive revenue unlock, growing our sales-led revenue with three-figure growth rates from 23-Q1 to 23-Q2, so more than doubling revenue in a quarter. It’s exactly what customers upmarket want when it comes to CDEs: the control, security and compliance benefits of a self hosted offering, paired with the ease of use and administration of a SaaS service. Customers include companies such as Dynatrace, EquipmentShare, Quizlet and Adaptavist.”

My sense is that allowing customers to use their own cloud accounts is what gets medium-sized companies to open their wallets. The businesses Johannes mentioned employ 500-5,000 people, so aren’t small. And I’m not really surprised that at mid-sized companies there’s aversion to a hosted CDE solution, given the heightened risk of vendor lock-in, and the potential for poor cost efficiency, given that a hosted solution would not utilize compute discounts already negotiated with a cloud provider.

Gitpod cleverly made itself the first vendor many people think of, by organizing the first-ever conference dedicated to Cloud Development Environments, called CDE Universe. It ran in June this year, with companies like Shopify, Slack and Uber sharing their approaches to CDEs. I can recommend watching the recordings from the conference.

While other conferences touched on CDEs, such as Cloud Native DevX Day in 2021 or DevX Conf in 2022, CDE Universe was the first – and so far, only – conference focusing solely on this topic.

4. Stackblitz: a unique approach that does not use cloud VMs

Stackblitz’s selling point is speed; it’s the only vendor that offers environments which boot in milliseconds. I was curious how the company does this, and asked cofounder and CEO Eric Simons. He shared:

“Unlike all other online IDEs, at Stackblitz we don't use cloud VMs to do any of the compute work. We do something quite different, instead.

We mount a micro-operating system written in WebAssembly inside your browser tab that boots in <200ms. This approach is very analogous to the technical approach that made Figma possible for design (utilizing new browser capabilities with WebGL & WebAssembly). We are the first folks who have been able to do it for powering dev environments.

The benefits of this approach are huge: no latency, works offline, users don't have to pay by the minute to use it, etc; all the same reasons local environments are fantastic, except now it boots instantly in any browser tab.“

The company shared more details on its approach in the article, Introducing WebContainers: run Node.js natively in your browser. Its target market is web development teams; from open source teams, through startups, to Fortune 500 companies. But how does Stackblitz compete with other CDE solutions? Eric says it’s down to latency, especially when building UIs:

“In general, web development workloads are latency-sensitive because of the visual feedback loops required for it. Cloud VM based IDEs provide a substantially worse experience with regards to latency. This makes our in-browser technology a natural fit and also provides enhanced dev and debugging experience beyond what the local environment can do. For example: with Stackblitz, you can use Chrome DevTools to debug API responses – and, thus, the backend – and not just work on the frontend.”

One powerful validation for StackBlitz comes from Google; the company uses Stackblitz to power all of its live examples on the Angular website, and for the Material Design website.

5. DevZero: the influence of Uber, and thinking beyond “only” CDEs

DevZero was founded in 2021 by two engineers who’d worked at Uber, which built an in-house CDE called “Devpods” – which we cover in more detail in this article. DevZero takes a lot of inspiration from Uber’s development environment.

DevZero launched in 2021 and entered an already crowded market. I asked cofounder and CEO Debosmit Ray, (who goes by “Debo,”) for details on how the company is carving out a market, and how DevZero stands out among CDE vendors. Debo shared:

“You can bring any IDE, all of your personalizations (e.g. dotfiles), and any other developer-specific customizations into our ecosystem. We support every Jetbrains IDE, Eclipse, Atom: you name it. Generally speaking, we try to find ways of making the local IDE connect to the remote file systems over SSH and then get the debugger to work. In the rare case that this would not work, we fall back to rsync to use the IDE with the remote host. Our goal is to not lock customers into a specific IDE or browser-based IDE.

Another notable difference is that our primary deployment mode is a hybrid one: customers are responsible for the cloud-resource spend. So, when a user wants additional RAM, CPU or storage, they can click a button and the DevZero platform will move the workload to an instance with the requested resources.

We provide some proactive cost management features such as customizable, stateful resource hibernation policies and reactive features such as our cost management dashboards, resource utilization APIs, and various cloud-resource tagging. We’ve also started highlighting if environments are over provisioned, or facing issues from being under-provisioned. Customers seem to find this useful.

We also support GPU and other HPC configurations for data and machine learning-focused workloads.”

Debo shared that the “typical” DevZero customer who sees immediate ROIs are teams of 25+ developers, and that ROI is much easier to justify, the larger a team is. Another differentiator is that DevZero is already thinking of what comes after CDEs, and how to make development environments closer to production:

“We have slowly been moving away from being ‘just’ a CDE provider. With DevZero, you can define a production-symmetric environment once. Then, you can use it in an ephemeral way (for a very short time) for any stage of the software development lifecycle (SDLC.)

This means you can leverage the same environments for things like:

Code review and preview environments

Continuous integration (CI)

Dev/QA/UAT clusters

Staging environments

Security testing

You can configure these environments in many ways:

With several Kubernetes pods with database in an ephemeral Kubernetes namespace

Or a few ephemeral ECS tasks chained together

Or a few lambdas running ephemerally, etc

All of this is on top of getting the power of the cloud for development.”

Where did the inspiration for this approach come from? Not too surprisingly, partly from Uber’s development environment. Debo told me they’re hoping to bring the Uber internal Cerberus and BITS-like capabilities to all engineers.

Cerberus was an Uber-internal system to develop against production data. A few years ago, I did a talk in which I mentioned how Cerberus works. You can view it here.

BITS is a library to handle test tenancies, in order to safely run integration tests. Here’s how Debo summarized BITS, and how they plan to further build upon the idea:

“BITS was an internal app-level library at Uber where the application would respect tenancy, using the (“x-uber-tenancy” header). Using BITS, developers could run full integration tests in the CI against downstream services, knowing that they wouldn’t impact production logic or mess with production database entries.

At Uber, all applications were forced to run in production or staging tenancy. However, in DevZero platform, we can have true namespacing-based isolation, because we are not bound to two tenancies (effectively two namespaces).

As an example of the problem which true namespacing-based isolation solves: take a team with the developers, Alice, Bob and Charlie. Alice is testing out an API-gateway update, while Bob is making a backend change, and Charlie is changing the database schema – all at the same time. In a normal setup, they would be stepping on each others’ toes. By separating namespaces, they can all do their work, not affecting one another – or production!”

DevZero is the only vendor in this list that highlights multi-region global coverage, has support for all IDEs and Git providers, and offers multi-cloud support. It’s also the only provider with a visibly higher price tag on their landing page, suggesting they are targeting enterprises that understand the value of spending ~$699+/year on a tool – not including the cost of infra! – that improves developer productivity for engineers.

An important note: DevZero is isn’t ready yet - their team is incorporating early user feedback and expect to go to market in early 2024. From Debo:

“Full platform readiness will still take a few more months and our strategy is to use customer/user feedback for our prioritization of features/capabilities. We really don’t want to ship half-baked tools since that loses developer trust when work is lost, or reliability isn’t there entirely. Given that we’re building infra, we’re trying to be a bit cautious.

I don’t believe that anything in the infra space will benefit from short-term ‘quick wins’ - if the capabilities aren’t there or dont work well, developers will figure it out one way or the other - and that’s just making overall engineering less efficient.”

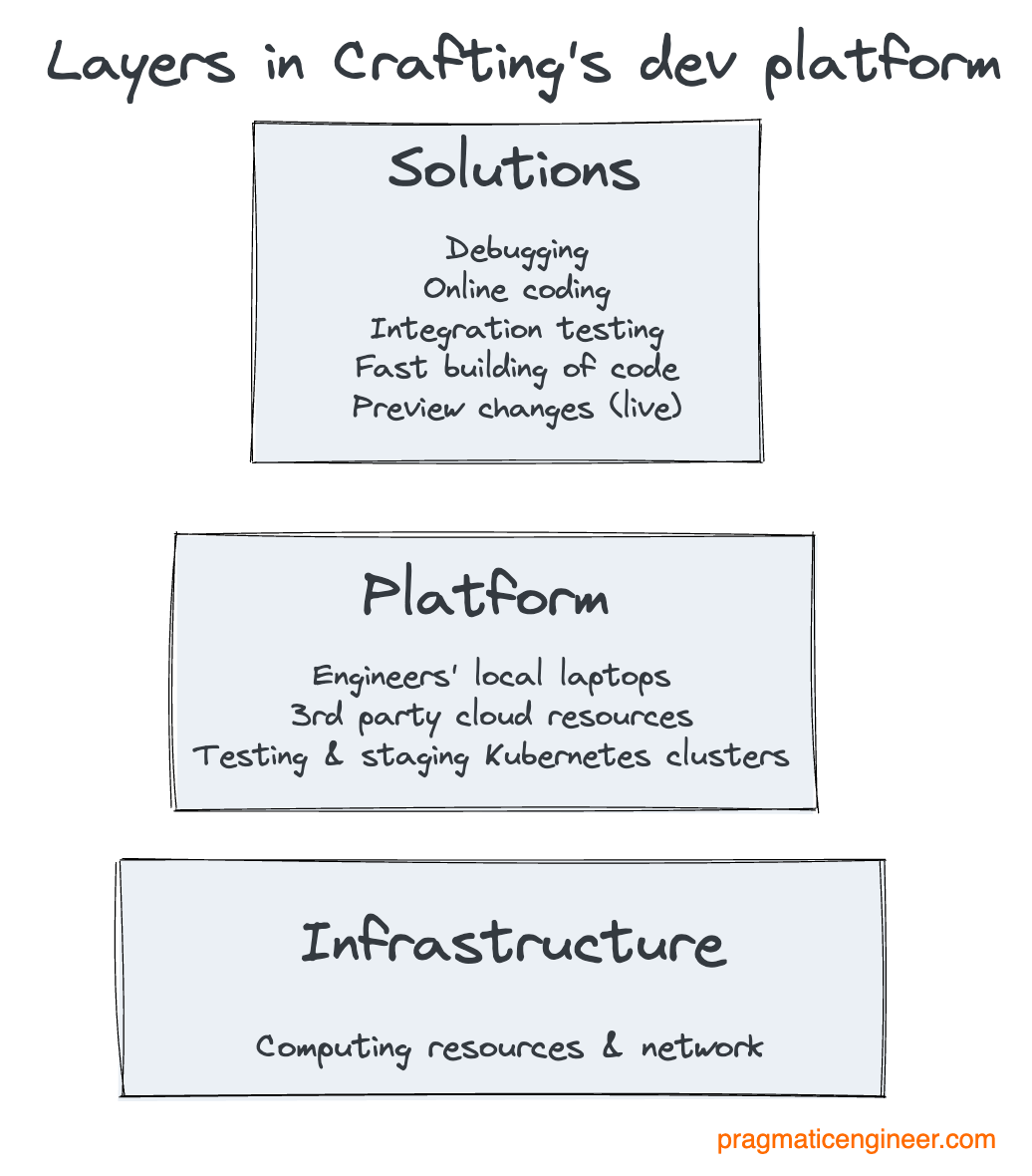

6. Crafting: thinking beyond CDEs

Crafting was founded by Charlie Gao, the cofounder and former CTO of e-bike mobility startup, Lime. He’s also worked at Square and Facebook. The other cofounder of Crafting, Yisui Hu, has worked at Microsoft, VMWare and Google, where he was on the Kubernetes team. The company has published customer case studies from organizations like Lime (e-scooters), Persona (identity management solutions) and Turing (a job platform for software engineers).

Crafting is the company that feels to me is flying under the radar, and doing so very deliberately. They don’t advertise their funding – nor did they tell me – but they have a bold vision, and some of the most advanced technology under the hood. Cofounder Charlie Gao shared more details, on how Crafting works, and here’s my interpretation of the platform:

The solution takes a more holistic approach to moving development to the cloud. Similar to how operating systems often are divided into three layers, so is Crafting:

Bottom: infrastructure. Manages the computing resources and networks between them

Middle: platform. A unified platform to bring everything together. Think of engineers' local laptops, 3rd party cloud resources, testing/staging k8s clusters, etc

Top: solutions. For example, for online coding; fast building of code; integration testing, previewing and debugging.

Crafting extends Kubernetes. Almost all CDE vendors build their solutions on top of Kubernetes. Crafting goes a step further and extends Kubernetes specially for running CDEs. For example, Crafting's dynamic memory control handles spikes of memory usage, which often occur when building or testing the code. The default Kubernetes behavior is to evict the container – and thus interrupt the developer’s workflow – Crafting allows the dev container to finish the work. This enables much better sharing between many developers on large cloud machines. It’s helpful to remember that one of the two cofounders came from the Kubernetes team itself: a neat addition when needing to extend Kubernetes!

I reached out to a company that uses Crafting extensively: Faire. Faire is a wholesale marketplace connecting retailers to indie bands to sell everything from furniture to clothese and beyond. The company is valued at more than $12B, having raised $1.5B in funding, and has a tech team well over 200 people.

The company uses Crafting to spin up one-off environments for engineers to work independent of staging. The engineering team was able to quickly replicate their own staging environment, and now any dev can “copy” one for local usage. The dev team told me they have a very positive experience with Crafting: devs can now work on the staging environment, parallel, without breaking anyone else – or staging!

7. Big Tech and established companies

Big Tech and established companies have also entered this market.

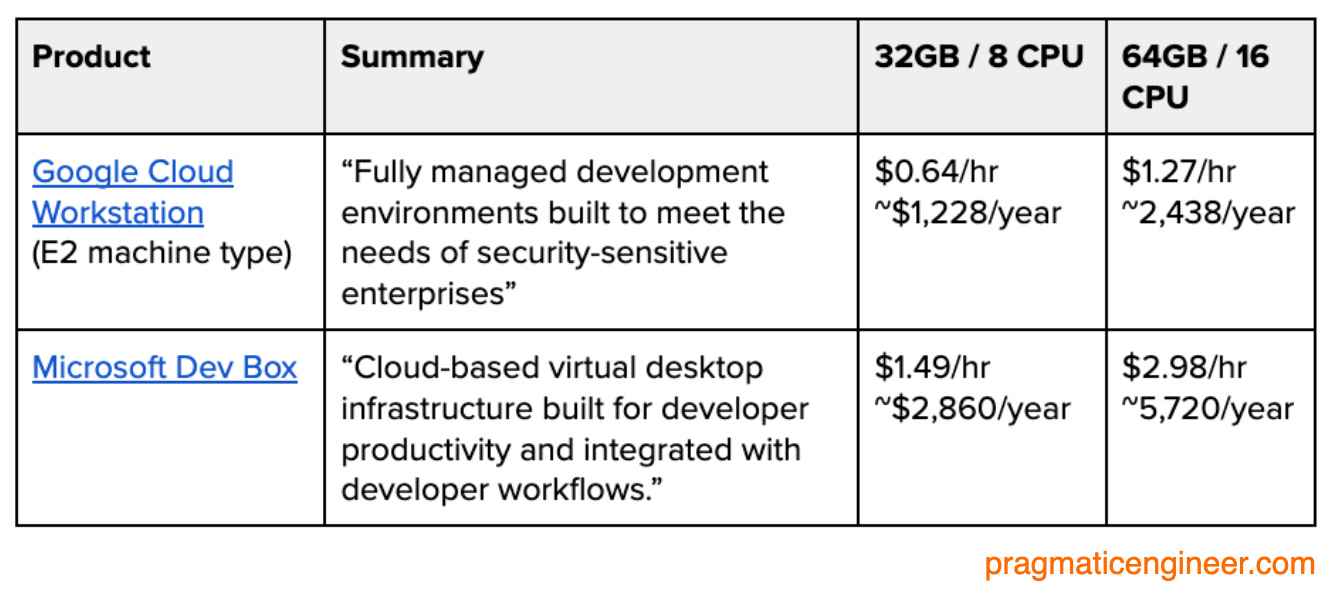

When it comes to these offerings, the feature sets and pricing vary dramatically. The only two providers I found to be comparable are Google Cloud Workstations and Microsoft Dev Box, which both offer to run a virtual machine in the cloud. In this comparison, Google’s offering fares better on price:

Microsoft feels like the company leading on remote development. GitHub Codespaces, launched in 2021, is the best-known CDE, and I wouldn’t be surprised if it had the most adoption across all vendors.

Microsoft Dev Box is a more recent offering, launched in 2022. Dev Box has a prerequisite for users to be licensed for a Windows distribution, or to have a Microsoft 365 subscription (that already has this license.) Dev Box pricing comes on top of these licenses: meaning Dev Box is a reasonable option for organizations where most developers already use Windows, or there’s an Office 365 subscription.

Dev Box – like Google Cloud Workstations – also has a security focus. Using Microsoft Intune, organizations can manage Dev Boxes just as secretly as they do a physical machine. Microsoft Intune includes identity management like custom roles and policy assignment, device compliance, and control over what apps run on the OS.

Talking with engineers at the company, I learned the Microsoft 365 organization – previously “Office” – moved to using the Microsoft Dev Box service on Azure in January. This is Microsoft’s offering for ready-to-code workstation clouds, and the service is currently in preview status.

Engineers provision a VM, specify which repository they want to work on, and then use the VM which is geared towards single feature development, and disposed of afterward. I talked with a software engineer in the M365 organization who described the experience:

“The great part about this service is that it comes pre-loaded with everything you require to run code in the repo you are planning to develop. This approach has been a game changer. I’m seeing pretty good adoption across the org.”

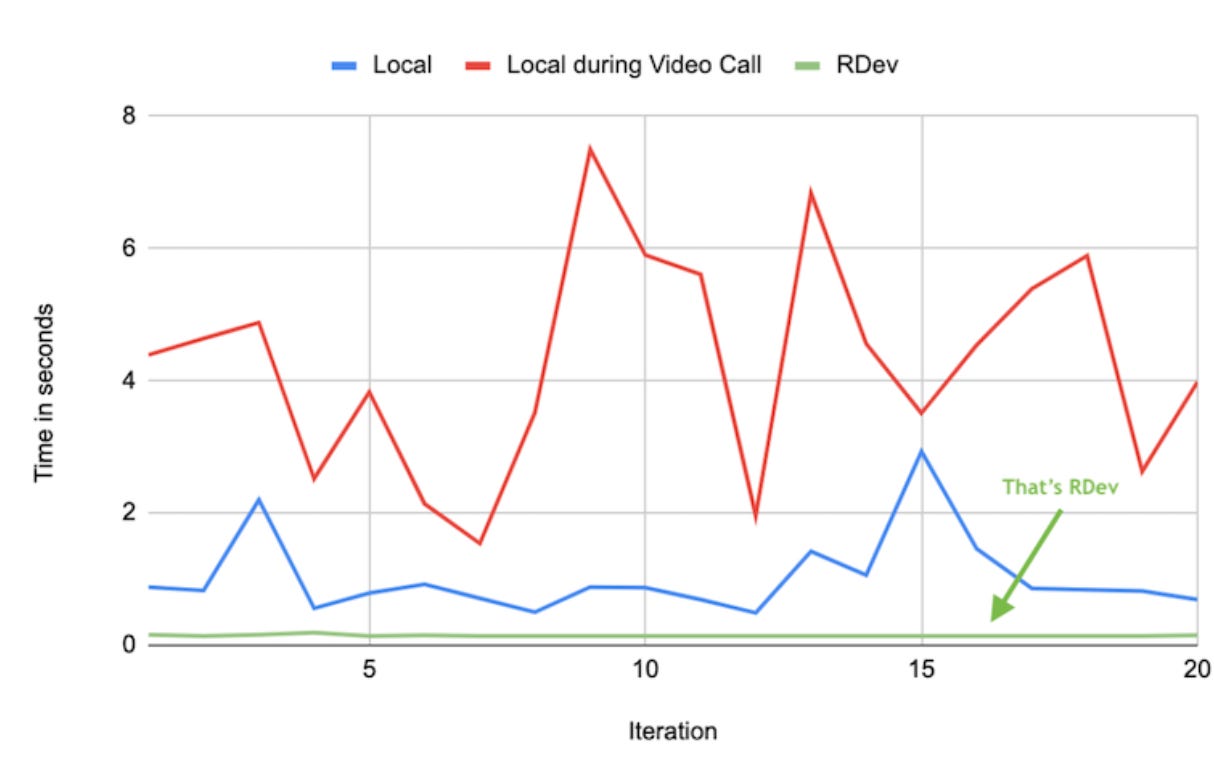

LinkedIn – a division of Microsoft – built its own solution called RDev in around 2020. LinkedIn uses its privately managed Cloud platform to provision remote developer machines. It is serious about measuring developer productivity and also does this with RDev, having found that RDev makes a huge difference, especially when video calls happen on the local development machine:

In some ways, it is reassuring to see organizations like LinkedIn and GitHub continue to operate independently within the Redmon tech giant. Assuming CDEs continue their rapid adoption across the industry, I’d expect that in a few years Microsoft pushes for groups like LinkedIn to onboard an externally offered CDE, such as GitHub Codespaces or Microsoft Dev Boxes. In the meantime, I wouldn’t be surprised if the Codespaces and Dev Boxes teams turn to the LinkedIn developer productivity team to understand how and where LinkedIn’s internal solution works better than those offerings.

Google feels to me like it’s playing catchup to Microsoft, but does want to compete in the developer space. Google Cloud workstations are very similar in their capabilities to Microsoft Dev Boxes – except they are cheaper while offering similar security and other capabilities. Cloud Workstations can be accessed over a browser, or a local IDE. Cloud Workstations supports Visual Studio, and all JetBrains IDEs.

Google very recently launched IDX, which is a web-based workspace for full-stack application development, complete with the latest generative AI tools. To me, IDX feels like it is taking on Visual Studio Code for web development. IDX is in private beta at time of publication.

Amazon was a Big Tech giant with an early lead in the space, thanks to a strategic Cloud9 acquisition. But the online retailer has failed to capitalize to become a leader in remote development environments, despite being in the market several years before Microsoft and Google.

Cloud9 was the earliest pioneer in the remote development environment space. Founded in 2010, Amazon acquired the company in 2017. Cloud9 is an AWS service, and so requires customers to have AWS accounts. The service works by provisioning an EC2-instance in your account, and then you connect to this instance via the web interface.

Oddly enough, there has not been much traction for Cloud9 since AWS acquired it. I reached out to a former Cloud9 engineer, who worked at Amazon after the acquisition. They shared:

“AWS bought Cloud9, and then it felt like they didn’t know what to do with it. When AWS acquired Cloud9, they launched it as an AWS service, and shut down the startup version – and lost all existing Cloud9 customers at the time.

The model of being in the AWS console just doesn’t work that well. I’d say Codespaces executed the vision of Cloud9 much better.”

Still, it made me wonder how it’s possible that Amazon launched its CDE 3 years ahead of GitHub Codespaces, but for traction to feel very low. A few potential reasons:

Lack of discoverability. The AWS console has more than 150 products. Unless searching for Cloud9 in a targeted way – and looking under the category ‘Developer tools’, it is hard to discern that AWS has a cloud-based IDE solution.

Not much support. Garethy Dyer, cofounder of technical publishing company Ritza, shared his frustration as a customer: “I built stuff on Cloud9 after the AWS acquisition. It was a pain: badly documented, a lot of docs were from before the acquisition and it was always hard to know what was still valid. Even solution architects from AWS couldn't help much.”

Not perceived as a dev tools vendor. AWS is seen more as a cloud infrastructure provider, and not a developer tools provider. Companies like GitHub, GitLab, Jetbrains or CDE vendors, are seen more as developer tools, though.

A web-first approach. Cloud9 supported a web-based interface for a long time, and this interface was inferior to IDEs like Visual Studio Code. In 2021, AWS published a blog post on how to set up Cloud9 with Visual Studio Code, but this support is not out of the box.

Too early to the party? In 2017, cloud development environments hadn’t gained much traction. It was 2020-2021 when this shift kicked into full gear, as we covered in the article Why are CDEs spiking in popularity, now?

Whatever the reason, AWS seems to have squandered its early lead in CDEs.

Amazon launched its CodeCatalyst service in 2022, which seems like a more direct response to the likes of GitHub Codespaces, and also perhaps an admission that Cloud9 has failed to gain traction. CodeCatalyst supports creating dev environments in the cloud and supports CI/CD integrations (including support for GitHub actions.) CodeCatalyst is geared for projects built on top of AWS infrastructure, as it makes setting up AWS deployments very easy.

While CodeCatalyst seems like a sensible option for teams already building on top of AWS, I cannot realistically see Amazon taking the lead over Microsoft or Google in this space.

Red Hat is an active contributor to this space. In 2016, the company started to develop Eclipse Che, a Java-based workspace server and online IDE. In 2017, Red Hat acquired Codenvy – a cloud development platform with $9M in total funding – and released CodeReady Workspaces in 2019. In 2022, Red Hat retired CodeReady Workspaces, in favor of OpenShift Dev Spaces. We interviewed Mario Loriedo, principal engineer at Red Hat, who leads Eclipse Che development in the article Why are CDEs spiking in popularity, now?

OpenShift Dev Spaces uses Kubernetes and containers to provide a cloud-based developer environment. OpenShift is Red Hat’s enterprise Kubernetes container platform, and OpenShift Dev Spaces is offered at no additional cost for OpenShift customers.

OpenShift pricing is added on top of AWS, Azure or GCP infrastructure prices. For example, when using AWS, OpenShift charges at $0.171 per 4 vCPU used by worker nodes, which would be an annual ~$328 plus AWS infra charges for a developer box running 40 hours a week, 48 weeks a year.

JetBrains Space is a complete platform for dev teams that provides these components:

Git hosting

Code review environments

CI/CD pipelines

Internal chat

Issue tracker

Cloud development environment

JetBrains Space feels like a play to try and break out from being known as “the IDE company.” It’s a competitor to GitHub, GitLab and other, specialized vendors, like CI/CD ones.

CDEs are a subset of JetBrains Space which the company calls “Space Cloud Dev Environments.” Pricing is based on “Computational credits,” where for $8/month buys 80 hours of dev environment time. As a nice touch, Space hibernates dev environments after 30 minutes of inactivity – and bills a much lower storage quote for hibernated instances.

Latency could be an issue with Dev Environments because Space is hosted in the eu-west-1 region of the Space Cloud. This means that outside of Europe, Space users observe significant latency. At time of publication, Space Dev environments are not available as self-hosted, although Jetbrais is working on adding this support.

GitLab Workspaces is a virtual sandbox environment for developers’ code in GitLab. A workspace is defined by a Devfile, which specifies the languages, tools, runtimes and other components of the project. When creating a new Workspace, this spins up a virtual environment, which is a pod running in a Kubernetes cluster.

GitLab Workspaces only supports a Web IDE – thus no support for IDEs like VS Code, even though Web IDE is a VS Code fork.

Takeaways

There’s an absolute flurry of startups which provide tools for remote development. Between 2010-2020, we saw a couple of startups launch in competition with each other, but it’s since 2020 that there’s been a lot more activity, and new product launches seem to be speeding up. Here is a summary of all the vendors and products mentioned in this article:

Microsoft and Google started to take this space seriously as of 2021-22, and Amazon also has its own offerings. Established players in the space like Red Hat, GitLab and Jetbrains are doubling down as well.

It feels to me like we could be nearing an inflection point: after which more developers will work with remote environments at medium and large companies, than those that use only their local machine to develop. I am reinforced by this feeling as I talked to vendors who all have a pretty clear vision on what they want to build: but their products are still being built out, and I had trouble keeping track with the various innovative approaches they are all trying!

There are several reasons why cloud development is becoming popular, right now. Remote work, monorepos, and the spread of the public cloud all play parts. The productivity boost is enough of a productivity boost that large tech companies are building their own, custom implementations – Uber, Slack, Shopify are such examples. It is no surprise that vendors are sensing a business opportunity and are building products, as we rounded up the vendor landscape in this article.

Latency is still important: and not all solutions do well here. Having servers run close enough to developers is tricky to do with vendors that run out of one or two data centers. For example, a developer based in Australia connecting to a data center in East US will experience latency that could be frustrating enough to make remote development not practical.

“Bring your infra” for these cloud backends is a way to work around this: and to provision virtual machines in data centers close enough to developers. This is also what Uber does: using five different data center regions, ensuring developers get allocated virtual machines close to their physical locations.

CDEs are gaining foothold in more “traditional” environments as well. When researching this article, I talked with an engineer working at Fortune 500, publicly traded financial services company. This firm uses a cloud IDE as the only tool allowed for open source contributions. The business has a virtual desktop running on Azure and the IDE in GitHub Codespaces. This is the environment in which engineers are allowed to make open source contributions.

The motivation for this setup was security; the company wants to protect its intellectual property and minimize data leaks: and the security team found this setup more advantegous. The company has controls in place to block any code being pushed to external repositories from company machines. The cloud development environment is the only exception, from where a push is allowed.

Will most developers at large and mid-sized tech companies build software on a remote machine in 2-3 years time? And will they do this in a way that’s indistinguishable from doing it locally? It’s hard to be sure, but I believe this is the direction we are headed in.

Special thanks to Geoffrey Huntley for discussing his views on the CDE vendor landscape.

Related articles:

Amazing report