Should you optimize for all-cash compensation, if possible?

Although still rare in the industry, companies like Netflix and Shopify let employees choose how much of their total compensation is stock. What are the approaches to take?

👋 Hi, this is Gergely with a bonus, free issue of the Pragmatic Engineer Newsletter. In every issue, I cover topics related to Big Tech and high-growth startups through the lens of engineering managers and senior engineers. In this article, we cover one out of four topics from today’s subscriber-only The Scoop issue.

If you’re not a full subscriber yet, you missed this week’s deep-dive on Shopify’s leveling split. To get full issues twice a week, subscribe:

Across tech, it’s not that common to issue stock to all software engineers. Of course, Big Tech and most “tech-first” companies at which software engineering is a profit center, do this. Making key employees who create value into shareholders is a common practice, as it aligns interests.

For example, say a software engineer comes up with an idea, ships it, and it generates a new revenue stream for the company. At a more “traditional” company that issues no equity to employees, this employee will probably get a nice end-of-year bonus and perhaps a modest pay rise. But they have little incentive to stick around and work on the new project, even though they probably have plenty to contribute and could help generate a lot more revenue.

At a company that does issue equity, this employee will get it – and the bonus could be really nice – and also get a larger equity allocation. Now, the employee has good reason to stick around and see their equity vest, and also to ensure their project creates as much value as possible. The more successful the project, the more value it makes for the company, which boosts the stock. The employee wins as their already large equity allocation is worth more. And, of course, the company also wins: as the company’s other shareholders capture most of this value increase. It gave up a little equity, in the hope of a much bigger benefit.

Of course, the problem with stock is that its value also goes down. And at any company that rewards valued employees like software engineers with large equity packages, a drop in stock price creates a retention problem. Suddenly, people will feel like they’re paid less, even though they’re working as hard or even harder than before. This is the problem many tech companies including Shopify have experienced with stock prices falling since mid-2021.

Shopify’s stock value fell 79% between September 2021 and September 2022:

The most common way companies respond to such drastic stock declines are these:

Issue higher equity refreshers, intended to counter a falling stock price. While this approach sounds good, it’s also very expensive. And the company would be taking on the risk of the stock price going down, making it not really a sustainable approach.

Shorten vesting windows. Instead of exposing employees to 4-year vesting windows — with the ups and downs over this period – just issue stock at a dollar value, and convert it to cash on vesting. For example, this is what Stripe and Lyft are doing. It reduces the downside employees see with stock price movements, and also reduces the upside. This approach could make more sense for companies whose growth is expected to be either modest, or negative.

Offer employees their choice of equity exposure. The benefit of issuing stock to employees is that stock compensation impacts cash flow less. For companies with good cash flow, they could simply let employees decide how much of their annual total compensation target to take in cash, and how much in stock. Netflix is the most known for this approach.

Shopify decided to allow for option #3 by rolling out Flex Comp. We covered more on Flex Comp in Tuesday’s article on Shopify’s leveling split.

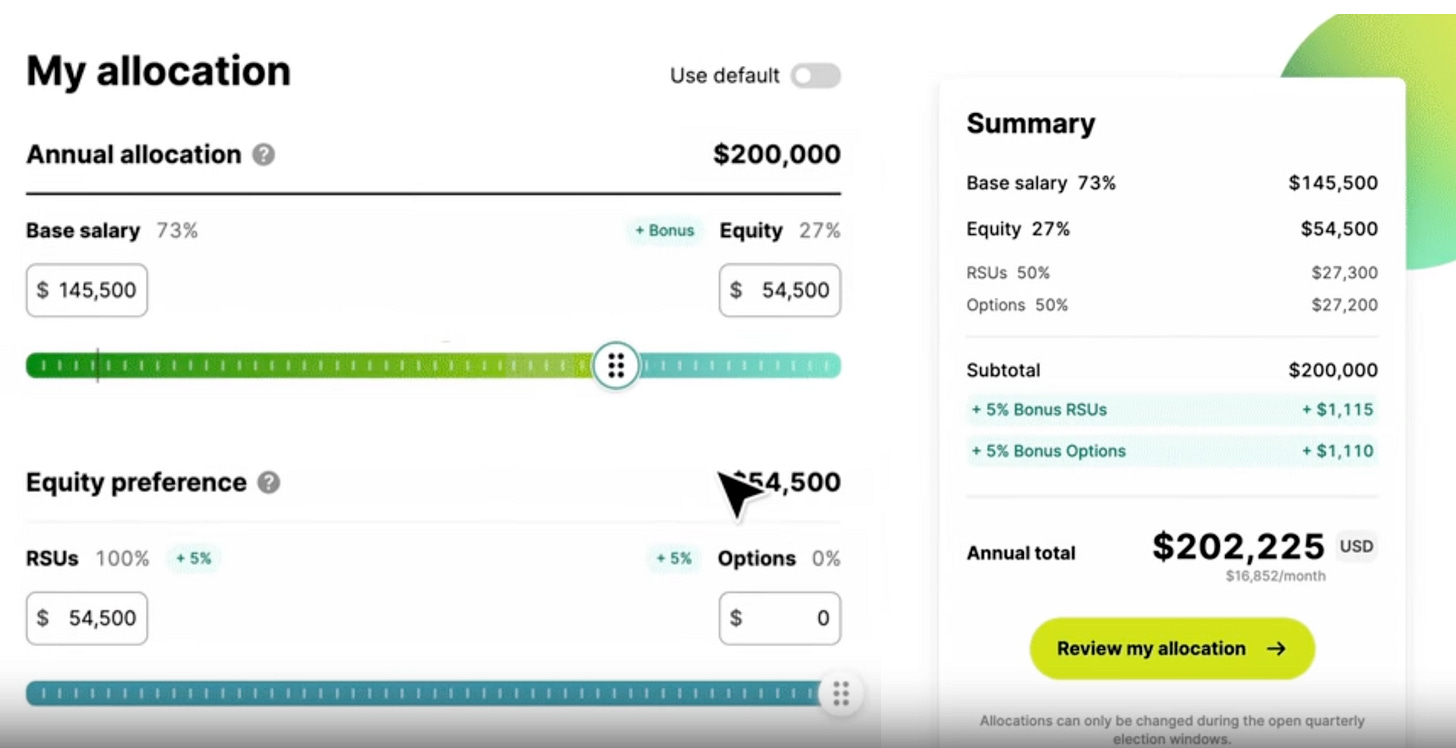

Now, employees can choose which percentage of their compensation target they allocate to stock, and what stays as cash. Here is how that interface looks like:

At level L7 and above, there is an expectation to take at least a given amount in stock, which I’m told is around 5% at first, and 20% at higher levels. This constraint is sensible from the company’s point of view; it’s very much in Shopify’s interest for senior staff to have more skin in the game.

In September 2022, when this new system was rolled out, most software engineers I talked with were wary of too much exposure to the stock market, after seeing their stock holdings melt. People I talked to opted to take all or most of their compensation in cash. Hindsight is 20-20, but looking back at what’s happened since, those who diversified – and opted to take more of their compensation in stock – have seen better financial outcomes, at least to date. This is because Shopify's stock price doubled the past 9 months:

So, if given the choice, should you take most of your compensation in cash? Looking at Shopify, in the past year this would have been the less profitable option. However, how could employees know the company’s stock price would increase by as much as it did?

Well, as an employee you have access to a wealth of “insider” information which public investors do not see. You know about big-bet projects in the company, have access to business dashboards and you can attend internal all-hands about business strategy, competition, market share, etc. You could gather details that make you more bullish about the company. If you have such information, it could be a calculated risk to allocate more of your compensation to stock.

However, no matter how many “insider” details you have, one thing you don’t control is how the stock market values the company. And value depends on many external factors, as shown by the negative impact of US interest rate rises on many stocks.

Here’s a thought experiment: say you could accurately predict how Shopify’s revenue and loss change between September 2021 and the following 2 years. Knowing this, would it have been smart to buy or sell the stock in September 2021? And when would it be sensible to buy more stock? Here’s those numbers, mapped out, and how the stock really performed:

Looking at the data, the company’s revenue keeps growing and its profitability decreases. However, there seems to be less correlation between the business metrics and the drastic stock price change, than the numbers indicate. So, if I had access to these accurate projections, I would’ve still been unable to know with a high level of certainty when to buy or sell stock, in order to maximize returns.

How much you invest in your own company’s stock will be driven by your risk appetite. Investing in any stock is risky: it has potential upsides and downsides. You have some insider information, but that information is unlikely to help you accurately predict stock performance over time.

Among tech workers, two common approaches I’ve seen to splitting cash and equity exposure, are:

Reduce your equity exposure. Take as much cash as you can and put it in low risk investments. Index funds are a popular destination

Keep some of your compensation in stock. Take most out as cash and invest it, but keep some in the company if the outlook is decent

Take a big risk because you can, and you believe you have good information. When you believe your company is set up for success – and you can afford to be wrong and even lose on your equity position – then there’s more scope for risk. But decide in advance what you’ll do if the stock does poorly

Needless to say, none of this is financial advice, and I don’t hold any individual company stocks. I do this to reduce potential bias in my reporting, not because I lack conviction in some companies. Decide on the strategy most appropriate for you, given your current situation and knowledge. Don’t be afraid to change your approach as your situation changes or you refine your views, based on more information.

This was one out of the four topics covered in this week’s The Scoop. A lot of what I share in The Scoop is exclusive to this publication, meaning it’s not been covered in any other media outlet before and you’re the first to read about it.

The full The Scoop edition additionally covers:

Pinterest’s new levels and reduced compensation bands. L15 is the new L5 in Pinterest’s new leveling system. As the new levels were rolled out, compensation targets dropped by around 30%. I checked in with current engineers on how they feel about the change. Exclusive.

Pay rises at Shopify. Together with recent re-leveling, the company awarded unexpected raises. I got details on the numbers, including what high performers got. Exclusive.

Who might buy Lyft? There’s signs that the US’s #2 ridesharing company could be open to a sale. Who might buy it? Analysis.