Software engineering job openings hit five-year low?

There are 35% fewer software developer job listings on Indeed today, than five years ago. A look into possible reasons for this, and what could come next.

Hi, this is Gergely with a bonus issue of the Pragmatic Engineer Newsletter. In every issue, I cover topics related to Big Tech and startups through the lens of engineering managers and senior engineers. This article is an excerpt from last week's The Pulse, issue – full subscribers received the below details seven days ago. Many subscribers expense the newsletter – if you have a learning & development budget, here's an email you could send to your manager.

If you’ve been forwarded this email, you can subscribe here.

Before we start: despite the below stats, the tech market is not all gloom and doom! This week, we covered pockets of the tech industry that are seeing more demand than before in the issue State of the startup and scaleup hiring markets – as seen by recruiters.

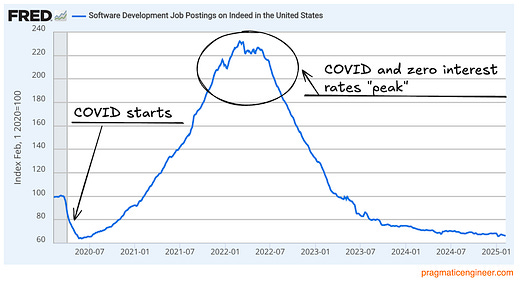

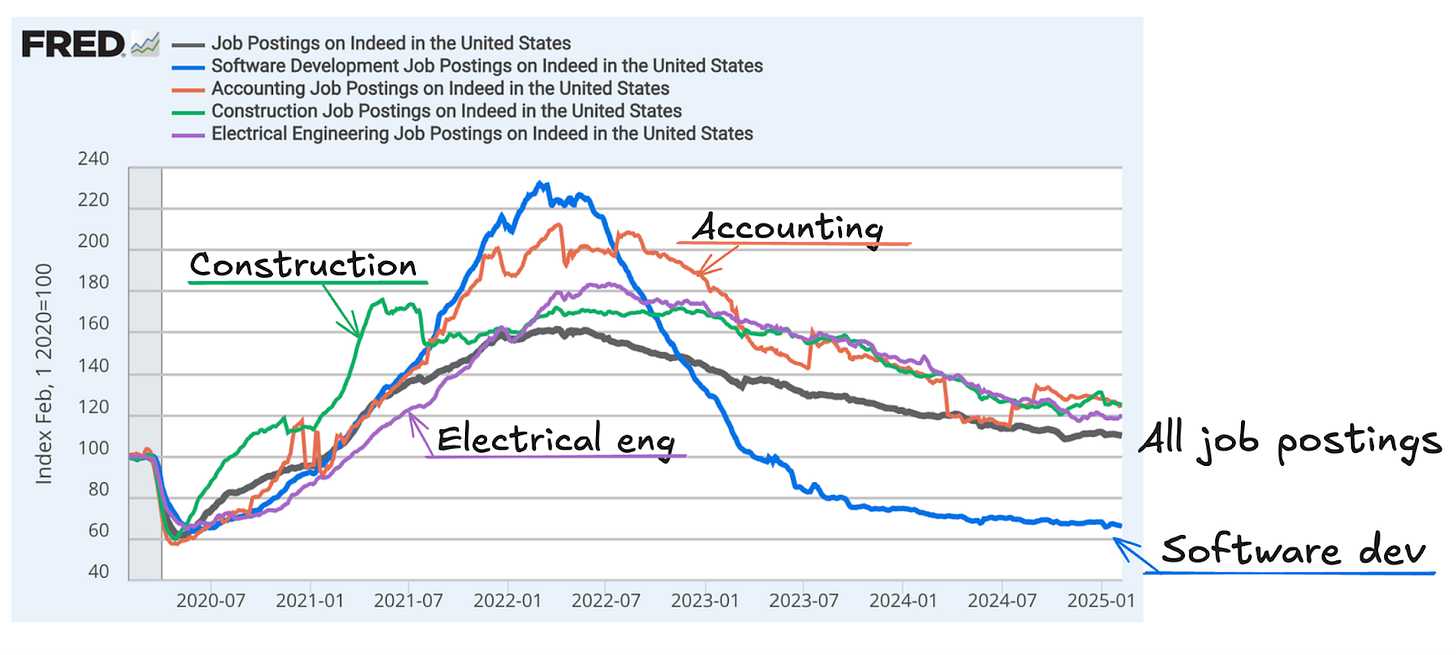

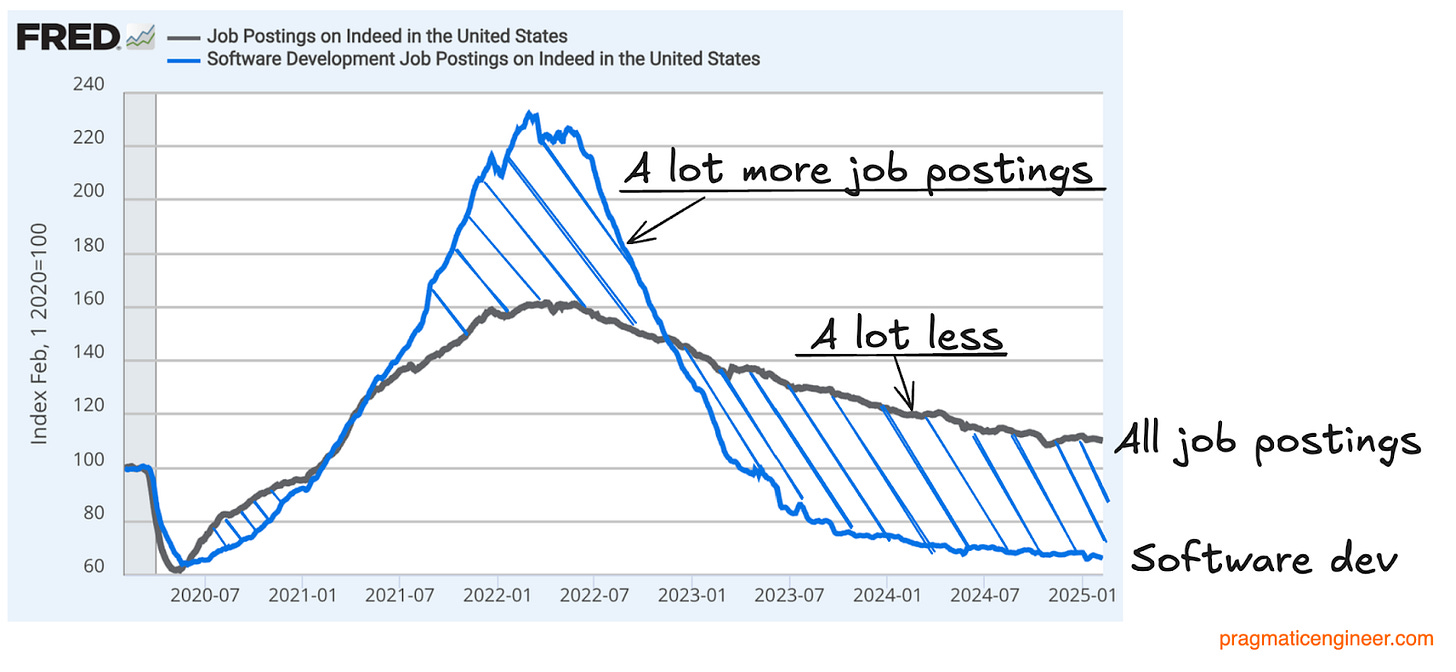

Interesting data from jobs site Indeed shows the change in the number of active software developer job listings on the site. For context, Indeed is the largest job aggregator portal in the US and in several countries, and it crawls vacancies on other sites, too. This means that Indeed aims to track most of the posted jobs across a given region (via crawling and processing them) – not just the ones companies pay to post on Indeed. The overall picture looks pretty grim, right now:

Since February 2020, Indeed has shared aggregated statistics on the number of active jobs listings, taking January 2020 to be 100%, as a reference.

Facts about software developer jobs on Indeed:

65% of the number of vacancies in January 2020

3.5x fewer vacancies than the mid-2022 peak

8% down on 1 year ago

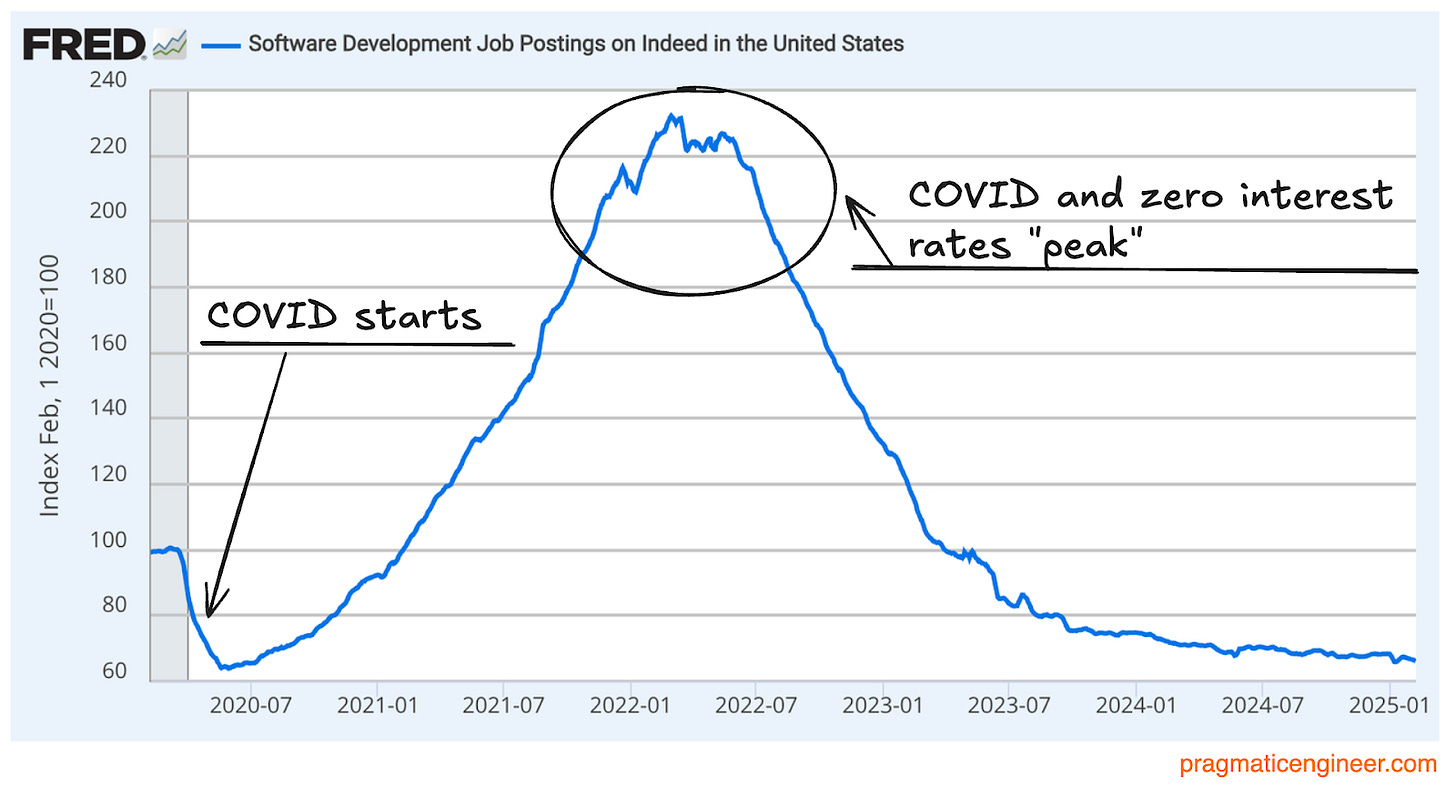

Indeed tracks international job markets, too. Canada has virtually the same graph as the US. Things are different in the UK, France, Germany, and Australia:

Trends look similar across the world. Australia’s growth in software engineer positions is eye-catching because it’s higher, and it’s the only country where the number of jobs listed is not lower than in 2020.

Section 174 — the accounting change effective from 2023, forcing software engineering costs to be amortised over 5 years is most likely to result in fewer software developer jobs in the US, as we have previously analyzed. The drop in jobs somewhat lines up with when this change became effective. However, Section 174 only impacts the US and US-headquarters companies. its impact would only be visible from early 2024 — and the drop since 2022 can in no way be attributed to it.

Section 174 changes also do not explain why countries the UK and France see a similar drop in job postings. This suggests that although Section 174 changes in the US surely have an impact: this accounting rule change is not the main driver of this drop.

Comparison with other industries

What about the number of total jobs in other industries? The data:

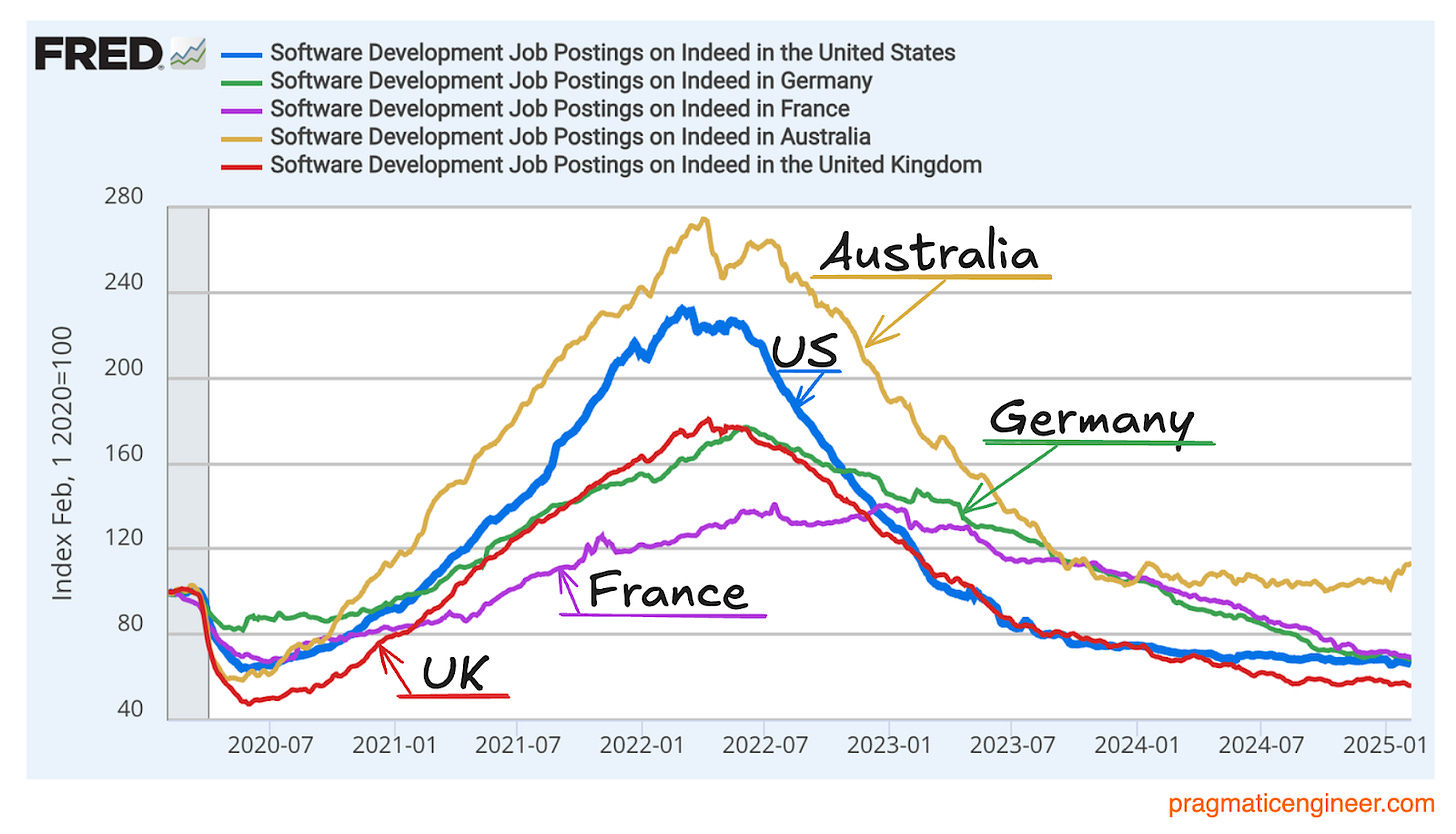

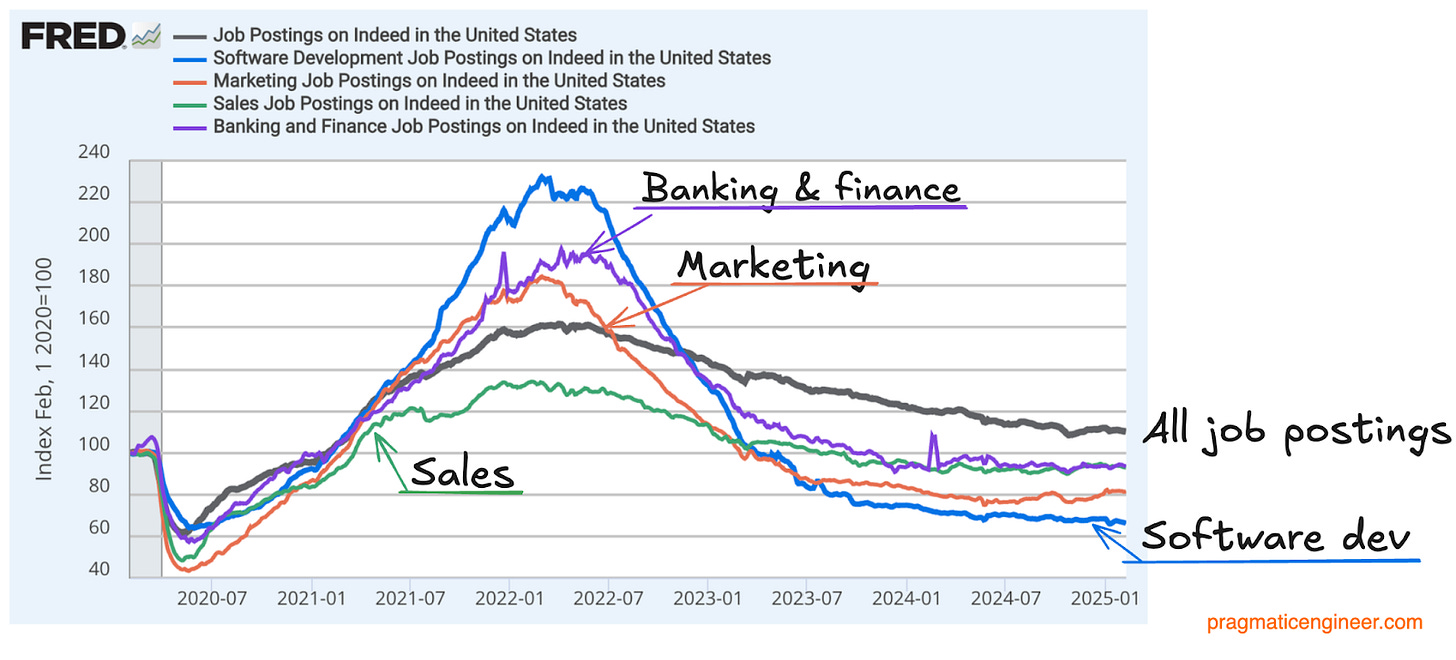

Across Indeed, 10% more jobs are listed today in February 2025 than were in February 2020. There are 35% fewer listings for software developers. Let’s dig a little deeper into which other industries are also experiencing a drop:

The change in the number of listings in 2025, compared to 2020, for each of these areas:

All jobs: +10%

Banking and finance: -7%

Sales: -8%

Marketing: -19%

Software development: -34%

Hospitality and tourism openings are also down by 18%.

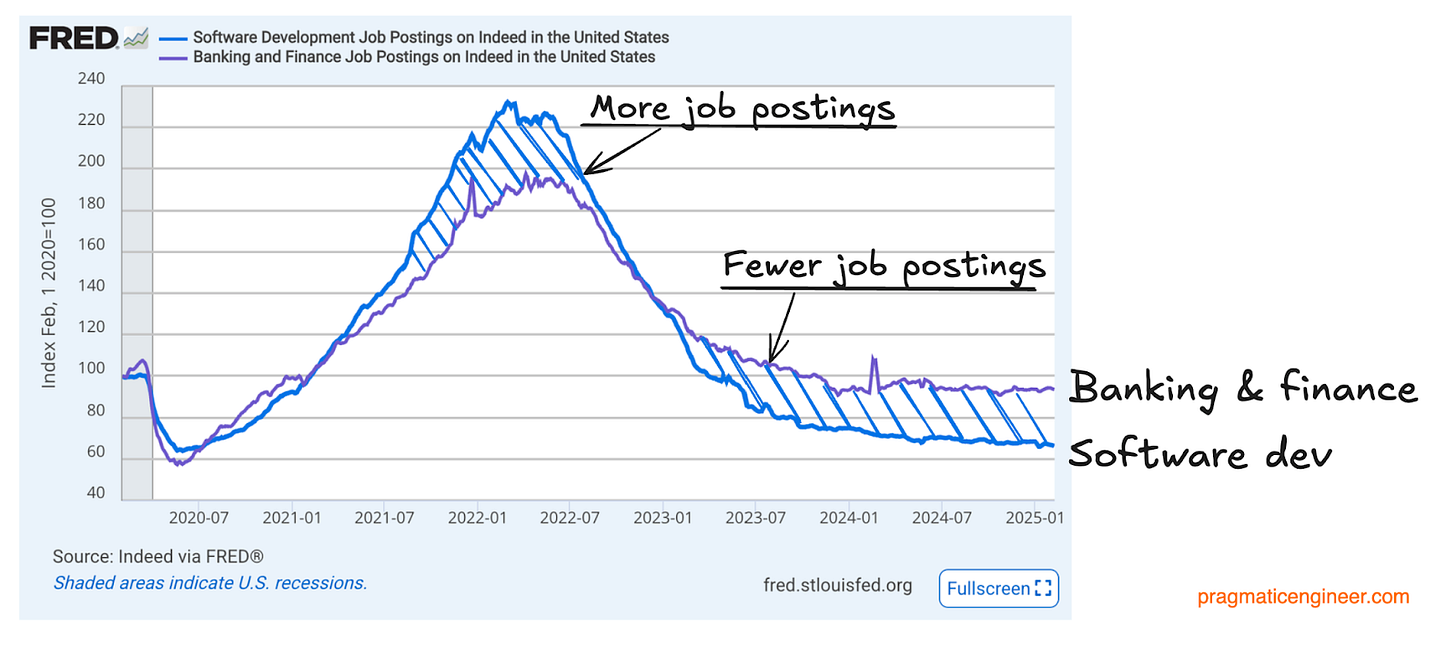

Overall, software developer jobs have seen the biggest boom and bust in vacancies. No other segment saw hiring more than double in 2022; only banking came close. At the same time, hiring has fallen faster in software development in the last 2-3 years than anywhere else

So, which areas have grown since 2020? Several sectors saw job listings go up, significantly:

Growth rates compared to five years ago:

Construction: +25%

Accounting: +24%

Electrical engineering: +20%

All jobs: +10%

Why have software dev job vacancies dropped?

The numbers don’t lie, job listings for devs have plummeted. There’s a few potential reasons why:

Interest rate changes explain most of the drop. The end of zero percent interest rates is a mega-trend that affects many things across the economy since 2022, including hiring, the steep fall in VC funding, and how many tech startups survive, thrive, or die.

But it doesn’t explain why highly profitable Big Tech companies like Microsoft, Meta, Amazon or Google have slowed down their hiring, or the large layoffs in recent years at tech’s biggest workplaces.

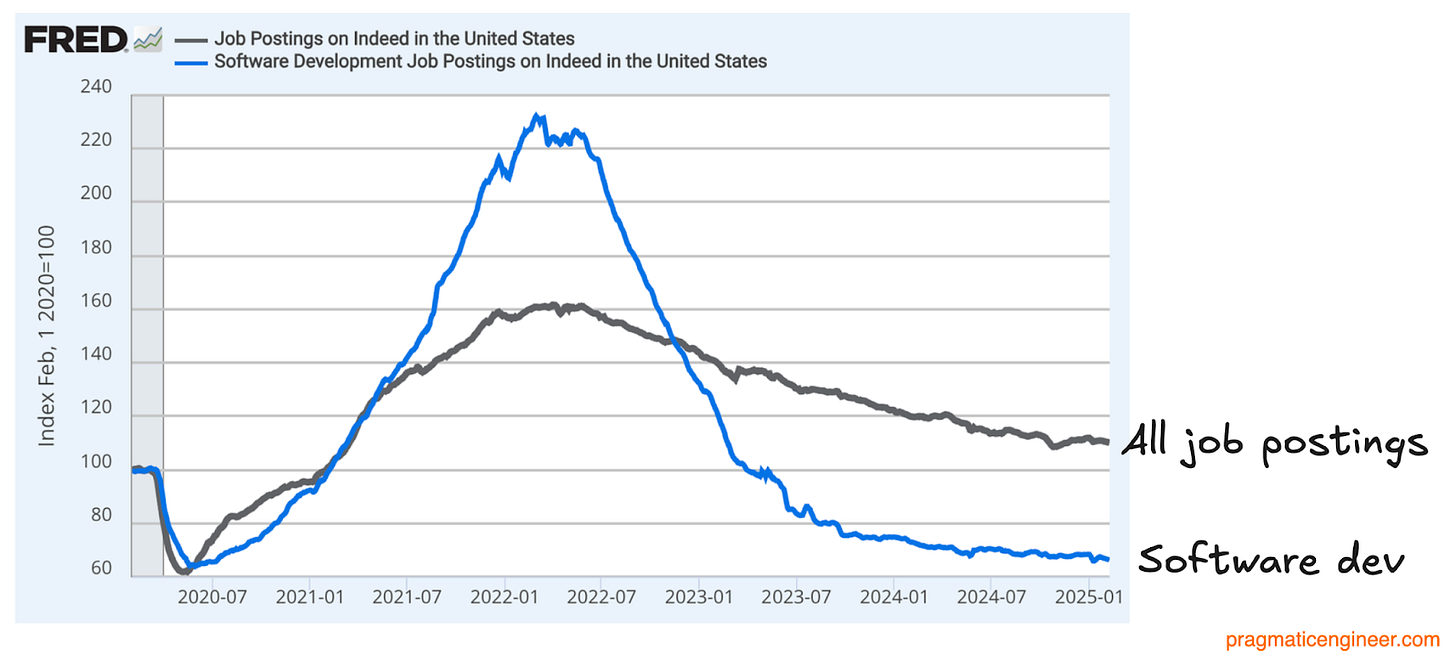

The tech sector seems to react to sudden events with more intensity than any other industry. There is no other industry that started to hire in the frenzy than the tech industry did in 2022 – and then no other industry cut back hiring in 2024-2025. Let’s compare it with the industry that had the second-largest hiring boom during COVID: banking and finance.

The job posting slowdown could partially be explained by how much more tech companies hired during the pandemic-era boom, and that companies are well-staffed thanks to that boom. Of course, we cannot deny that developer jobs – as well as banking jobs – are underperforming, compared to job listings across the economy:

GenAI impact - yay or nay? We know first-hand that coding is an area in which Large Language Models are really helpful. Indeed, would it be so surprising if coding goes on to become the single best area of all that LLMs thrive in? The discipline looks tailor-made for it:

Programming languages are simpler than human languages

More high-quality training material is available for coding than for any other domain, in the form of well-written source code that’s correct and works as expected. Much of this thanks to open source and GitHub!)

Coding solves hallucinations – mostly. One of the biggest problems with LLMs is frequent hallucination. However, by using these for coding:

Devs spot and fix hallucinations immediately, dismissing incorrect autocomplete suggestions

Compiling code and running it against automated tests weeds out another big chunk of hallucination – and this step can also be automated.

No other industry has workers immediately able to spot hallucinations, and automated tools to catch them. No wonder LLMs are being adopted faster by developers for day-to-day work than within any other industry.

AI tooling penetration is massive across developers: last year, about 75% of engineers said they use some AI coding tooling in our survey, AI tooling for software engineers: reality check.

Could tech companies be hiring less thanks to anticipating productivity boost that GenAI tools could bring for existing engineers? I don’t really buy this logic: but I can see how several companies could do a “wait and see” approach, slowing down hiring or even pausing it while they gather more data.

A perception that engineering is no longer a bottleneck could be a reason for lower hiring. As covered in January, Salesforce will keep software engineering headcount flat because it’s seen a 30% productivity gain from AI tools. Salesforce has an interest in making AI productivity sound compelling because it sells an AI offering called Agentforce, and the company can afford to hire 1,000 additional salespeople to sell its new products it’s built.

This suggests there’s substance in the reported productivity gain; Salesforce might be building software faster than it can sell it. Playing the devil’s advocate, this also raises the possibility that Salesforce isn’t building the right products, if it needs to hire more agents to sell its products, despite already having a strong distribution network and partnerships.

Still too many engineers, after overrecruitment in 2021-2022? The period was the hottest tech jobs market of all time, and companies hired at a record pace. In 2023, widespread layoffs followed. Sluggish hiring today could be an indicator that companies still have enough “excess hires” from 2022. Perhaps some companies feel they hired too quickly before, and are going slower now.

Are smaller teams more efficient? The two companies below hire slowly, and have small engineering teams:

Linear: 25 engineers. More than 10,000 companies use their product, including OpenAI, Retool, and Ram. Linear deliberately hires very slowly and it seems to be working, so far. We cover more on this in a podcast episode with Linear’s first engineering manager, and a look Inside its engineering culture.

Bluesky: 13 engineers. The social media startup crossed 30 million users with a surprisingly small team. Like Linear, Bluesky is growing slowly, and is incredibly efficient: their web, iOS and Android app runs from the same codebase, and was originally built by a single developer. More in Inside Bluesky’s engineering culture.

Could we be approaching the point at which building products is simpler to do for one or two engineers? Not because of LLMs, but how languages like Typescript allow working across the backend and frontend (using e.g. Node.js on the backend and React and React Native on the frontend and web). Of course, LLMs make onboarding to different stacks easier than ever.

Consider how Indeed job postings will not be fully accurate data. There is a fair chance that Indeed is becoming less popular as a destination to post jobs – especially software engineering jobs – and that Indeed is either not crawling, or banned from crawling them.

For example, Indeed lists a total of 663 jobs from Microsoft – however, Microsoft has more than 1,000 jobs just with the words “software” in them listed. I also struggled to find several startup jobs advertised on sites like Workatastartup (the job board for Y Combinator companies) listed on Indeed.

I suspect that Indeed’s data should be directionally correct, and there are indeed fewer developer job listings than before. But I don’t think this data is representative enough of startup hiring, and it probably doesn’t track Big Tech hiring all that well either.

What’s next?

Data shows that in 2023, the number of software engineers dropped for the first time in 20 years, fuelled by layoffs.

It’s predicted that growth in the tech industry is likely to be low this year, and most certainly well below growth between 2011-2021 growth. I see a few possibilities:

Smaller engineering teams get more productive. This is the optimistic outlook, where LLMs add a big boost to both individual and team productivity, which leads to more engineering teams being spun up, across the industry. More startups could be founded, and traditional companies could bring development in-house.

The industry stagnates / shrinks. In this pessimistic outlook, even as software becomes cheaper to produce with fewer engineers needed, companies produce the same software, but with fewer people. This also assume entrepreneurs will not jump at the opportunity to build their ideas more efficiently – and much cheaper than before! I cannot see the scenario of the shrinking industry playing out – not with good software missing from so many parts of the world, and building better software being a big business opportunity in some many other industries.

LLMs make software development more accessible for non-developers:

A) An explosion of startups offering “English-to-working-app” services. Offering software development services to non-developers on a budget has always been good business: LLMs could now make “democratizing software development” a reality. This is the pivot Replit has made, and it’s an angle for fast-growth AI startups like Lovable.dev and Bolt.new.

B) Software by non-developers creates more opportunities for devs. Imagine a situation where the number of non-developers creating software increases by 10x or 100x, due to AI, thanks to non-technical people creating software with AI tools and agents. Those projects which succeed and make money will have budget to spend on better development, and will have a motivation to do so. This could boost demand for developers in jobs for “taking over” AI-generated code, fixing it up, and improving it. This could be a boon for developers with entrepreneurial mindsets.

I’m sure that LLMs are a leading cause of the fall in software developer job postings: there’s uncertainty at large companies about whether to hire as fast as previously, given the productivity hype around AI tooling, and businesses are opting to “wait and see” by slowing down recruitment, as a result.

Startups are finding that smaller teams are working fine, and that it pays off to hire slower – as Linear and Bluesky are doing – and to avoid the “hyperscaling” approach of hiring first and asking what the new workers will actually do, later.

Big Tech will hire slower than before, and I don’t see startups speeding up hiring. What’s missing is an answer to the question: how much new software will be created by non-developers using AI tools, for which a lot more developers will be needed to grow and maintain those new solutions?

To understand more about why interest rates and startup hiring is tightly connected: see these deepdives where I analyze the biggest mega-trend impacting the tech industry in the last 20 years: