The State of Startup Funding in 2023

I’ve crunched data from a variety of sources for a sense of how startup funding is trending. So far, it’s downwards. What does this mean for tech? Analysis.

👋 Hi, this is Gergely with a bonus, free issue of the Pragmatic Engineer Newsletter. We cover one out of six topics in today’s subscriber-only The Scoop issue. To get full newsletters twice a week, subscribe:

A recent report in Carta’s newsletter caught my eye:

Angel rounds – or pre-seed rounds – usually total less than $1M in funding raised. These rounds are often invested in an idea, without the validation of a product-market fit.

Such a steep decline in the volume of angel rounds is concerning, as it may mean we see fewer companies ‘graduate’ into seed rounds when they validate there’s a problem space worth solving for.

But how indicative of the broader market is this one data point? I decided to dig in and got my hands on additional data from Pitchbook and Dealroom.

I also got an early look at the Q1 2023 Venture Monitor report by PitchBook and NVCA. This report shares data and analysis on quarterly US VC dealmaking, exit and fundraising activity. It confirms Carta’s findings that the angel and seed market’s at a 2.5-year (10-quarter) low:

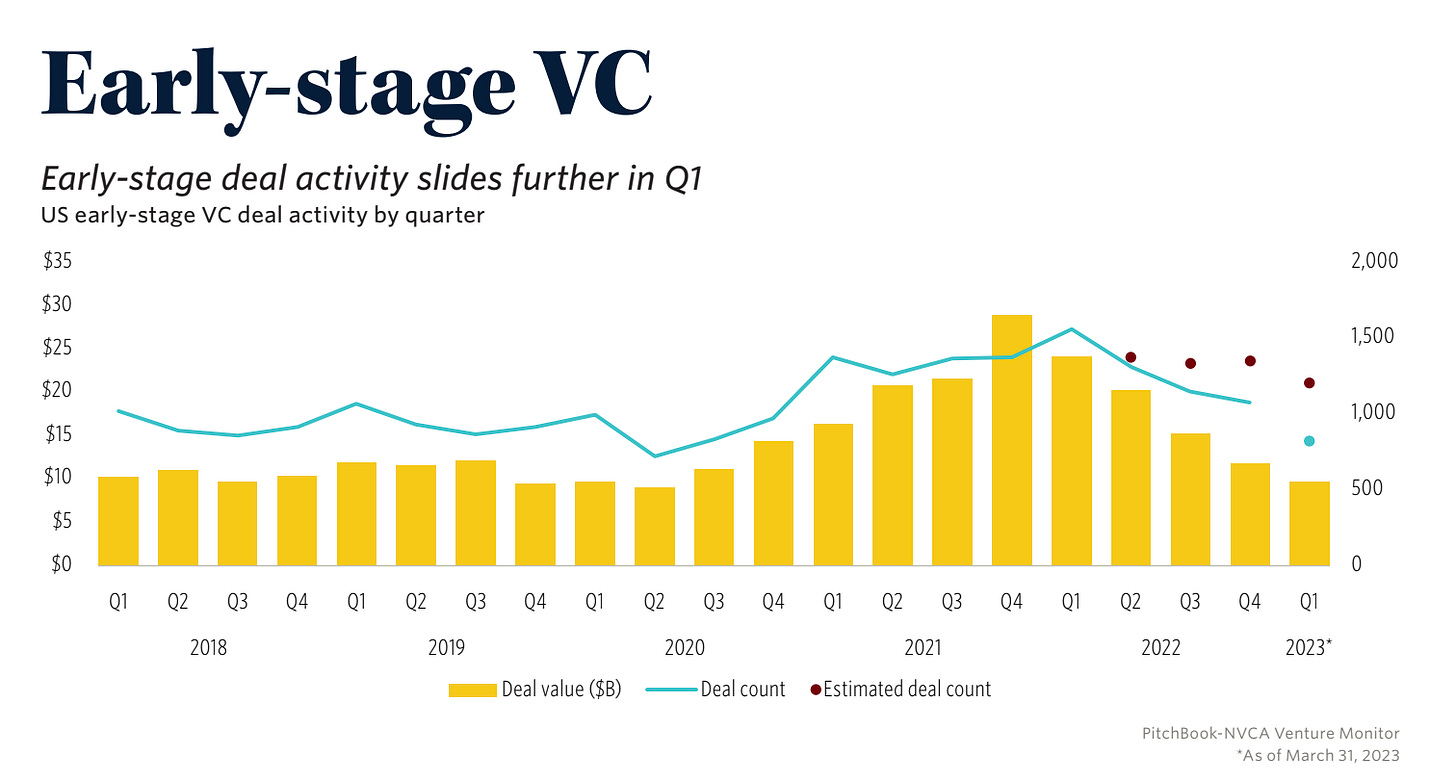

Now let’s look at the stages after seed: Series A and B; also known as ‘early stage VC.’ Here’s how investments in the US have changed, quarter-on-quarter:

And what about Series C and D rounds; late stage VC funding? Things look more grim:

The last funding round stages tend to come before an exit: these are Series E or later rounds - also referred to as “venture growth” rounds. Things are looking better in this category:

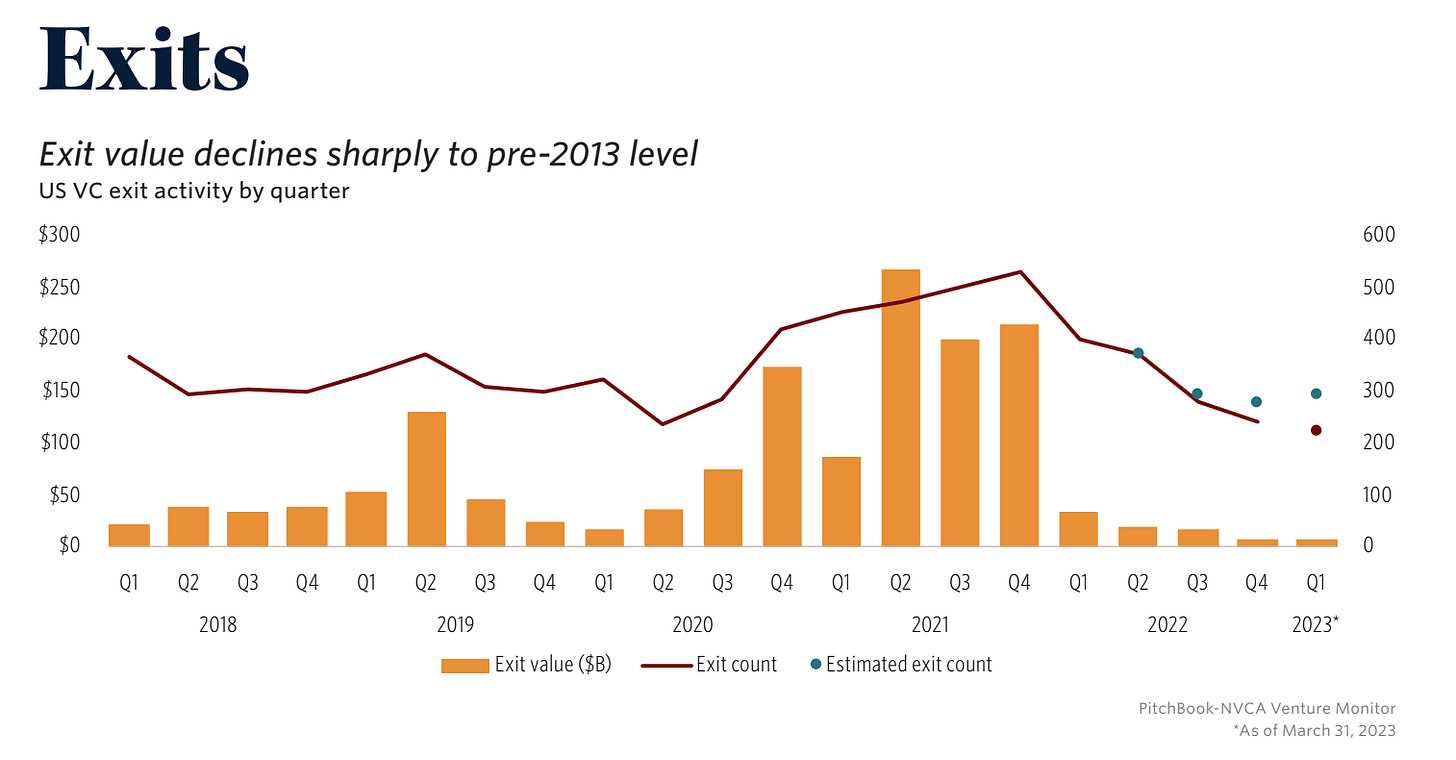

The goal of VC-funded companies is to achieve an exit and generate returns for investors. An exit means either listing on a stock exchange or being acquired. We know IPOs are few and far between at present, but what about other exits? The data’s even worse than for late-stage funding:

What about Europe? I turned to Dealroom for a sense of the funding round there. Here’s how Angel rounds in Europe are doing:

In 2022, Angel rounds were at the lowest by cumulative value since 2015, which is even worse than we’ve seen in the US. But what about seed rounds in Europe, typically of $1-4M by check size?

Seed investments have dropped since 2021, but in 2022 were around the same level as in 2020 – and well above 2019.

Zooming out, how have all investment rounds stacked up against previous years? Based on data for Europe, via Dealroom:

Wow, what happened in Q1 2021, when VC funding practically doubled? This was when the Covid-19 pandemic and lock downs were in full swing, and digital businesses boomed. And venture capital investment in tech also soared from that point. The peak of amounts invested was Q2 2021, but investment remained outstanding until Q3 2022.

I analyzed the Dealroom data by stage to understand more about today:

Series A investments still at early 2021 levels (!)

Series B back to 2020 levels

Series C back to 2020 levels

Series D+ at 2020 levels

Venture capital investment in Europe seems to be at or slightly above 2019-2020 levels across the market, by this aggregated chart. Yes, it’s a dramatic fall from 2021, but in line with investments pre-2021.

So let’s sum up the findings.

In the US:

Angel and seed investments are back at 2020 levels (a 2.5-year low)

Series A & B investments are back at 2020 levels (almost a 3-year low)

Series C & E investments are back at 2018 levels (a 5-year low)

Series E+ are back at 2020 levels, but on an upwards trend

Exits are at 2013 levels (a 10-year low!)

In Europe:

Angel investments at a 7-year low

Seed investments back to 2020 levels

Series A still at early 2021 levels

Series B+ back at 2020 levels

In the US and Europe, the venture capital market has reverted to 2020 levels or earlier. In Europe, investments seem to be back to 2020 levels across most categories. It is the US where things are a bit more puzzling: pre-seed, seed and Series A investments dropped to 2020 levels, but Series B+ investments seem to have fallen more, to 2018 levels. Most eye-catching is the lack of exits, which are at a 10-year low.

Exits can fuel more VC investments, so the lack of these exits will surely make it harder for VCs to raise more funds from their liquidity partners (LPs).

So should we see 2021’s high volumes as a symptom of an “unhealthy” funding environment? There was so much money in the market in 2021, as the charts clearly show. This level of VC investment appears unprecedented. Was it a good thing? Here’s what Stripe CEO Patrick Collison thinks, from the company’s annual letter:

“After a decade-long bull run, venture capital invested in startups declined by two-thirds in Q4 2022 compared to Q1 2021. While the market may have overcorrected, a correction was in order: in describing financing conditions in 2021, few would reach for “healthy” as their first adjective.”

My take is that in the way Covid-19 was an unforeseen ‘black swan’ event, so was the boom in tech and in VC-funding in 2021, which was definitely impacted by the pandemic, thanks to businesses and consumers shifting to digital, as a result of the lockdowns making in-person activities difficult and non-practical.

Now we can see how much VC-money poured into startups during 2021, it seems to explain why the end of 2021 was the hottest tech job market of all time: it was fueled by the highest-ever level of venture funding, along with the stock market rallying and Big Tech doubling down on hiring.

While less startup funding – and fewer job openings! – are not great news, reverting to pre-pandemic levels honestly seems like something which was always going to happen eventually. And still, the fact that there is significant venture capital flowing into the system is the reminder that tech has an established track record for creating high returns: and this expectation seems to have not changed from previous years.

As we wrap up, I have a favor to ask: I’m running the Tech Leaders Compensation survey, together VC firm CREANDUM to answer the question “how are engineering leaders at tech companies compensated?” If you are in a lead or management position and have a few minutes to spare, please share anonymous compensation details here. I’ll share detailed results in the newsletter around June - or add your email to get the report even before.

This is a collaboration I suggested after reading an earlier report from CREANDUM on an early-stage founders compensation report. I helped build the questions, and will also be analyzing results. I am not paid for this collaboration. For more details, see my ethics policy.

This was one out of the five topics covered in this week’s The Scoop. A lot of what I share in The Scoop is exclusive to this publication, meaning it’s not been covered in any other media outlet before and you’re the first to read about it.

The full The Scoop edition additionally covers:

Did Twitter fire too many people? Laying off 50% of staff 6 months ago – and more since – is starting to have a visible impact. Twitter’s firing spree looks like it was too fast and very expensive in several countries. Exclusive.

An update on Amazon’s return to office (RTO) plan. The company rejected a petition signed by more than 30,000 workers against returning to the office on 1 May. Could this controversy be an opening for smaller companies to poach Big Tech engineers? Exclusive details and analysis.

Stripe’s impressive Ruby codebase. In its annual letter, Stripe mentioned it has more than 50 million lines of code. I was interested in how this translates to the number of services, and talked with engineers to learn more about it and the codebase. Exclusive.

Is diversity spending taking a hit at tech companies? A software engineer at a diversity, equity and inclusion (DEI) vendor reports business is poor. What can vendors perceived as ‘cost centers’ do to reduce customer churn during challenging times like now? Exclusive.

Amazon’s ChatGPT guidance. Access ChatGPT or Bard from an Amazon computer and you’re greeted with a screen of guidelines about how to use – and not use – these AI tools. Exclusive.