State of the software engineering job market in 2024

A deep dive into job market trends, the companies and cities hiring the most software engineers, growth areas, and more. Exclusive data and charts

How’s the market for software engineers and engineering managers doing? During the past year, this publication took the pulse of tech recruitment pretty regularly:

Amazon reducing number of engineering managers a few weeks ago

Surprise uptick in software engineering recruitment in summer

End of zero percent interest rates and what it means for software engineers and managers

… and regularly touch on market changes and trends in weekly The Pulse issues.

Even so, nothing beats high-quality data for insights. To get some, The Pragmatic Engineer and two companies whose bread-and-butter is tracking employment stats and jobs data, have collaborated, and both businesses were kind enough to create the resulting unique data sets and charts for this article. They are:

Live Data Technologies: a startup based in California, which has developed a method of prompt-engineering major search engines to capture near-real-time data on employment changes in the US. They leverage this publicly available information to monitor 1M+ job changes, and 300M+ employment validations monthly, using a proprietary process. They can track hiring trends across companies, roles, functions, levels, industries, and locations.

The business normally sells this data to investors like VCs, private equity, quant funds, etc, and also to platforms that incorporate people data, such as sales tech, CRMs, talent platforms, private wealth, HR teams, and go-to-market leaders. It also serves as a data resource for well-known media outlets, including the Wall Street Journal, The Economist, The Information, Bloomberg — and today also for The Pragmatic Engineer! If you have questions about their data, please do ping Jason Saltzman!

TrueUp: a tech career platform that scans open jobs at Big Tech companies and “top” startups — doing this in real time. The company monitors 55,000+ open software engineering jobs across regions such as the US, Europe, India, and other major markets. Their platform processes close to 220,000 changes in listings per day from all tech jobs, and produces interesting analysis like hottest companies by investment, and sector reports. Because TrueUp only focuses on Big Tech and “top” startups, they will exclude many other tech jobs: and they thus typically focus on the top two tiers within the trimodal split of software engineering jobs.

Today, we cover:

How has the software engineering discipline grown / shrunk?

Which companies have the most openings?

Which companies are growing or shrinking?

Where do top companies hire software engineers from?

Which engineering disciplines are growing fastest?

Interesting details about seniority and tenure

How easy is it to find a new job?

How common are remote jobs?

Which cities have the most engineering job opportunities?

Which companies are hiring much less or much more than before?

What are the most sought-after technologies?

Related deepdives on the tech market from the past years:

The end of 0% interest rates: what the new normal means for software engineers (2024)

The “perfect storm” causing an insane tech hiring market in 2021

1. How has the software engineering discipline grown / shrunk?

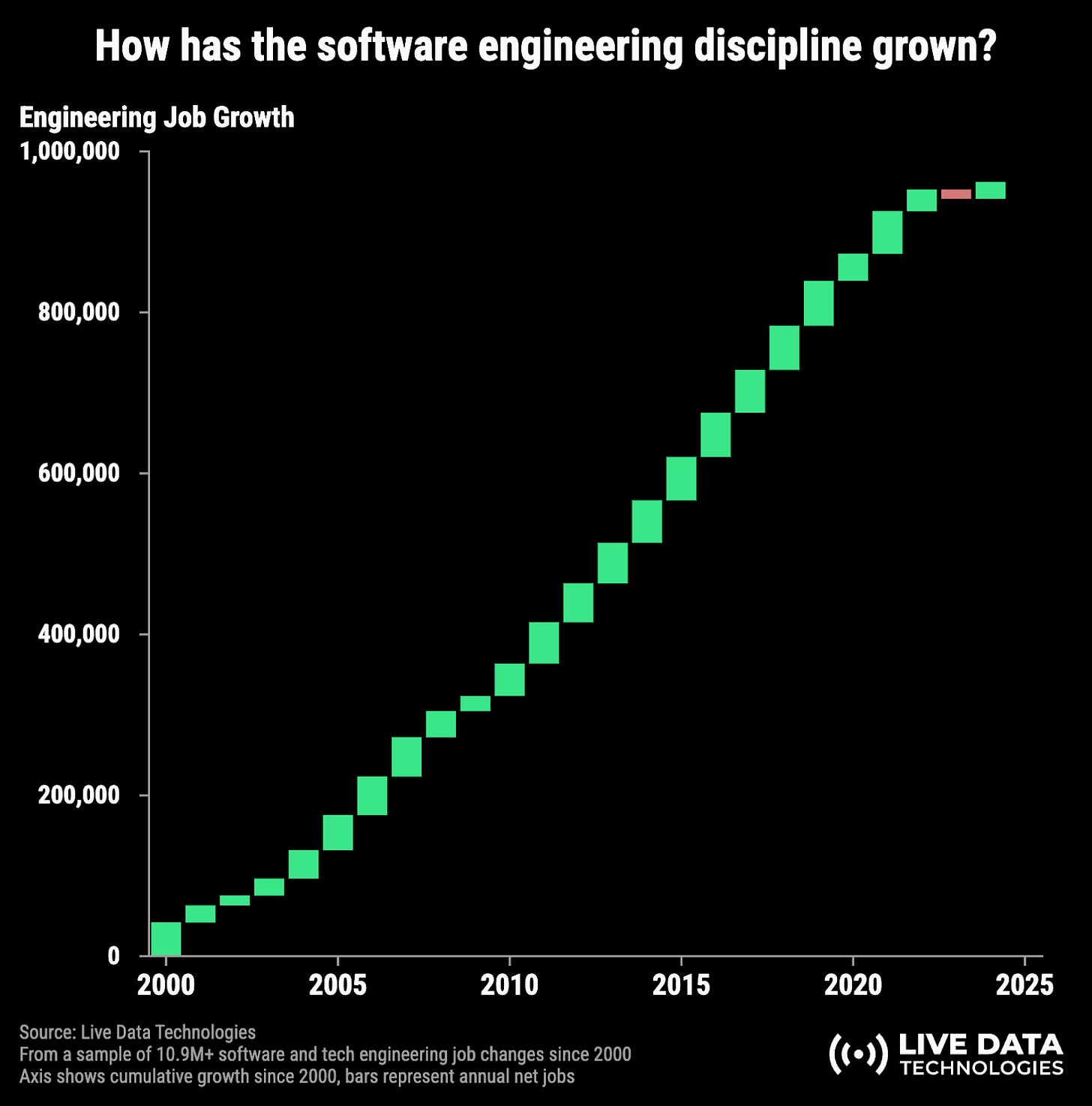

It feels that 2023 was a bad year for software engineering due to unprecedented large layoffs. Zooming further out from 2000, what are the long-term job trends? Here's the data:

An interactive visualization:

2023 was, indeed, historic as the first year since Y2K when the number of software engineering jobs shrunk. Growth has resumed this year, but it’s at least possible that a long-term flattening of the growth curve is emerging.

Let’s take a closer look at how the industry grew after 2001’s Dotcom Bust, and during the 2008-2021 zero interest rate period:

This visualization puts a few things into perspective:

In the 4 years after the 2001 Dotcom Bust, the tech industry grew relatively slowly

A decade of growth happened between 2011 and 2021 for combined reasons like the mobile and cloud revolutions, and massive VC investment during a zero interest rate period. Check out analysis of this in a deep dive on what 0% interest rates and their demise mean for tech

Since 2022, growth has slowed to levels not seen since 2001-2004

The future does not mirror the past, of course, and right now there's a cyclical slowdown in VC investment, coupled with huge AI investment. But elsewhere, there’s currently no similar triggers for growth like those of the smartphone and cloud revolutions from 2007, through the 2010s.

2. Which companies have the most openings?

Here’s how software engineering job openings have changed over the past two years, globally:

The good news is there’s been an uptick since the start of this year. The bad news is that the number of vacancies is still around half of what it was in 2022. This data matches a deep dive into global software engineering vacancies falling back to 2019 levels.

Companies hiring the most

If you’re looking for openings, here are the top 10 tech companies recruiting the most new software engineers:

This list has some surprises:

Amazon is unsurprisingly on top since announcing its full return to the office, which caused massive churn and the need to backfill

Oracle is a big surprise, and this hiring spike is covered in depth, below

TikTok and ByteDance’s aggressive hiring with 6x as many roles as rival Meta, is a surprise. This company is the only Asian business in the list, and shows how much the China-headquartered firm is investing. This is especially interesting given there are calls for the app to be banned in the US, or for it to be forced into a sale.

IBM hiring more than Google, Microsoft, NVIDIA, and Meta, is also a major surprise, and suggests the 114-year-old computing giant is doing pretty well.

SAP is the only European-headquartered company on the list and is the leader in Enterprise resource planning (ERP) software. SAP hiring enough to make it to the top 10 suggests their business outlook is also positive.

Other notable tech companies outside the top 10:

Senior-and-above engineering openings

Oracle hiring the most senior-above-folks by a wide margin is unexpected. Uber, PayPal, and Databricks, have a higher ratio of senior-and-above positions open than most other companies, and in larger numbers.

One important caveat to add here is Oracle’s “senior inflation” in titles. The Senior Member of Technical Staff (Senior MTS) at Oracle is the equivalent of L4 / Software Engineer 2 / mid-level software engineer at other companies. This caveat applies throughout all other senior-and-above categorizations at Oracle.

Engineering leadership openings

If you’re an engineering leader, the companies with the most leadership positions open are below. Again, the clear leader is Oracle.

Other places with open engineering leadership positions, in tech lead and engineering management:

Why is Oracle hiring heavily?

So many openings at Oracle in senior-and-above positions, is quite surprising. What explains this is that in the data set, “principal engineer” is considered a leadership position. However, at Oracle, the scope of a principal engineer resembles a senior engineer elsewhere in Big Tech.

Oracle seems to be doing very well, business-wise. The company’s market cap is an impressive $483B at time of publishing, making it the #11 biggest publicly traded tech company, just below Tesla ($693B), and Tencent ($508B), and above Netflix ($325B) and Samsung ($285B).

Here’s its market cap change over the last two years:

What’s behind this strong performance? Annual revenue climbed from $42B to $52B in two years, it remains strongly profitable at $8-10B per year, and forecasts to hit $100B revenue by 2029. Remember, OpenAI is projecting that it will also hit $100B revenue in 2029 – something I think is impossible in the time frame, given the company is expected to generate “only” $4B revenue in 2024.

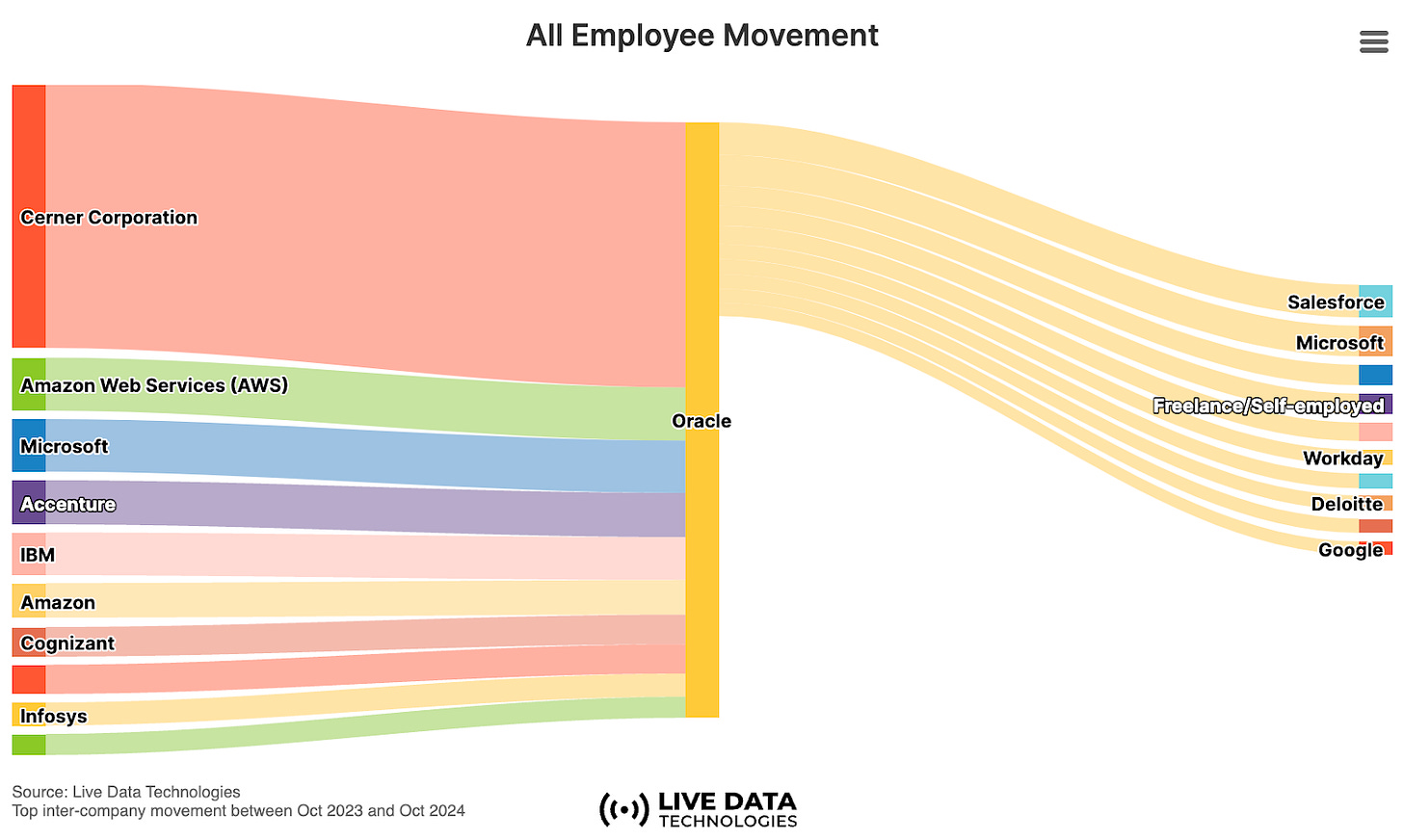

So, where does Oracle hire from? Using the Moneyball tool from Live Data Technologies, we can see recruitment in the last year:

Is Oracle hiring so much to backfill for attrition? Based on the data, the answer is “no.” Far more people joined Oracle last year than left.

Oracle acquired Cerner corporation in 2021, so that movement doesn’t really count. The biggest sources of hires are Amazon, Microsoft, Accenture, IBM, and Cognizant. Last year, many fewer people left Oracle than were hired. Among leavers, the leading destinations were Salesforce, Microsoft, IBM, NetSuite, and Workday.

3. Which companies are growing and shrinking?

Moneyball is a neat product from Live Data Technologies that’s open for anyone to use after registration. With this tool, up to 10 companies can be compared on headcount data. So, let’s take a look!

Which companies are growing their headcounts, and which have shrunk theirs significantly in the last two years?

Big Tech

Meta, Amazon, Google and Microsoft all did large cuts between the end of 2022 and mid-2023, meaning that:

Amazon and Meta have shrunk in the past two years

Microsoft is around the same size

Google has grown by around 7%

Apple is the only Big Tech company not to do layoffs, and grew in headcount by about 5% in that time

Apart from Google, no Big Tech company has shown notable growth for 6 months

Faster-growing companies

Which companies have grown headcounts rapidly in the last two years? The standouts:

NVIDIA is benefitting hugely from the AI industry’s rocketing growth, and briefly became the world’s most valuable company.

Tesla had impressive headcount growth until early 2024, after which the EV maker made job cuts.

Workday growing by 25% in two years is a bit puzzling, and seems to suggest the HR SaaS suite is doing very well. Workday is doing fantastic financially: revenue grew last year from $6B to $7B, and the profit (net income) went from slightly negative, to $1.3B. Headcount growth and positive financials suggest Workday is doing very well when few similar companies can say the same.

Airbnb seems to have been on a hiring spree throughout 2022, and headcount has been flat since.

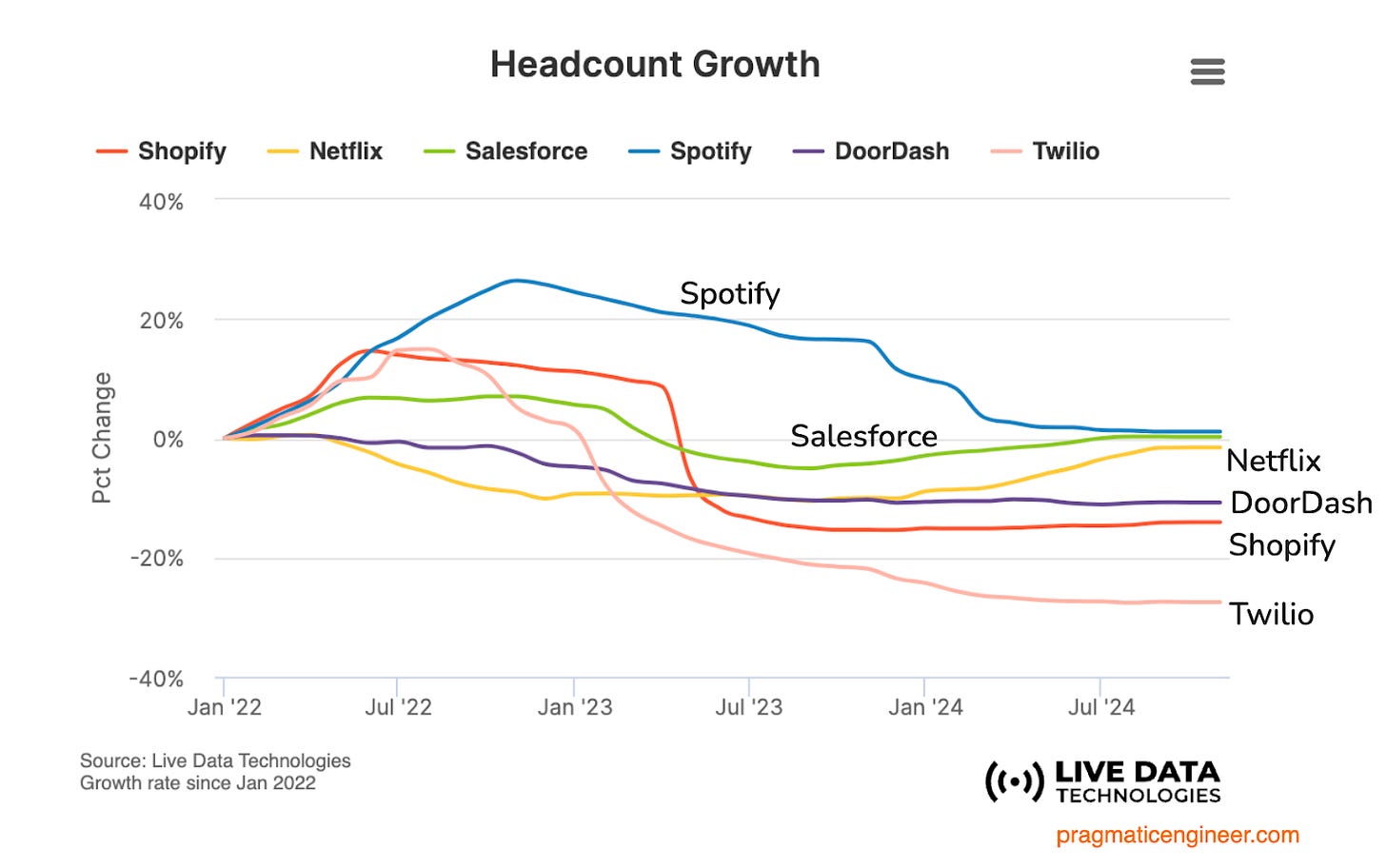

Shrinking workplaces

Which larger tech companies have seen the most headcount reductions?

Twilio had several layoffs: 11% in September 2022, 17% in February 2023, and 5% in December 2023. Today, the headcount is 27% lower than two years ago. At the same time, it was one of the first to commit to full-remote work in a powerfully-worded statement two weeks ago.

Spotify did deep job cuts from the middle of 2022, and more in late 2023, which reduced the workforce by around 25%.

Shopify had a very deep cut early 2023, and has kept headcount flat since.

Salesforce did layoffs in early 2023 and hasn’t been hiring since.

DoorDash has done no mass layoffs and seems to be letting natural attrition of about 10% per year do its job by not backfilling. Check out a deep dive into typical attrition for software engineers.

4. Where do top companies hire software engineers from?

Hottest AI companies

OpenAI, Anthropic, xAI, and Mistral, are the hottest AI companies. They each raised billions in funding, are growing at what feels like exponential pace, and all could be “rocket ships” in terms of company and career trajectories. From which places do these leaders hire from? The data:

Most common sources of hires by company:

OpenAI: Google, Meta, Stripe, Rockset, Microsoft

Anthropic: Google, Stripe, Meta, Cruise, Slack

xAI: Tesla, Google, Scale AI, OpenAI

Mistral: Google, Meta, Amazon, NVIDIA, Chronosphere

Google is the biggest source of all hires by these companies except for xAI, where more Tesla employees join. Elon Musk is CEO of Tesla and founder of xAI.

It’s interesting that OpenAI is already a sizable-enough recruiter to show up in the data, at xAI. Also, the Chronosphere-to-Mistral transition is interesting, and we cover it in The story of Chronosphere.

Also check out articles on OpenAI’s engineering culture, and how Anthropic builds products.

Big Tech

Last week, we looked into why techies leave Big Tech; but from where do software engineers join the largest tech companies?

Companies hired from, by popularity:

Amazon: Microsoft, Google, Tesla, Accenture, Boeing

Meta: Microsoft, Amazon, Google, TikTok

Google: Microsoft, Amazon, Qualcomm, Apple, Intel

Microsoft: Amazon, Intel, Google, VMWare

Apple: Google, Qualcomm, Intel, Amazon, Microsoft

There are few surprises:

Intel and Qualcomm are popular sources of Big Tech hires. Both companies have high engineering bars. Intel is struggling business-wise, so it’s little surprise people are leaving. Qualcomm seems to be doing better; my sense is that higher compensation packages might be partly why some of its staff move to companies like Google and Apple.

Where’s Meta? I assumed the social media giant would be a major source of hires for companies like Google, but it did not make the top 5 places from where Big Tech companies hire. This that Big Tech doesn’t need to hire from Meta — they find enough strong candidates from other companies!

Amazon and Microsoft hire from each other a lot. The #1 company Amazon hires from is Microsoft, and vice-versa. A likely reason is that both are headquartered in Seattle, pay similar compensation, and their offices are in close proximity.