The Pragmatic Engineer in 2023

The articles you enjoyed most this year, my personal favorites, and a recap of an unusually turbulent year in tech.

👋 Hi, this is Gergely with a free issue of the Pragmatic Engineer Newsletter. In every issue, I cover challenges at Big Tech and startups through the lens of engineering managers and senior engineers. If you’d like to get emails like this in your inbox, you can subscribe here.

2023 was the second full year of The Pragmatic Engineer, and this newsletter is now almost two and a half years old; the first issue came out on 26 August 2021. Thank you for being a reader, I greatly value your support.

This year, 102 newsletter issues were published, and this is number 103. You received a deepdive issue on Tuesdays, and every Thursday it was “The Pulse” – formerly The Scoop. Occasionally, there was a bonus article on Wednesdays, too, such as about the book, Tidy First?

Like last year, these newsletters all add up to 5-7 books’ worth of information. And speaking of books, this year I finally published the project I’ve been busy writing for years on the side of the newsletter: The Software Engineer’s Guidebook. This turned into a four-year-long endeavor; thank you to everyone who purchased the paperback edition. Kindle and audiobook formats are expected in early 2024.

Today’s issue is a look back at 2023, with pointers to articles you may want to reread, or discover for the first time. We cover:

The newsletter’s evolution

The most popular articles, and my personal favorites

New resources and templates for engineers and managers added this year

Tech industry pulse in 2023

For reviews of earlier years, see The Pragmatic Engineer in 2021 and in 2022.

1. The newsletter’s evolution in 2023

One thing that didn’t change this year was the publication schedule: Tuesdays are for more in-depth pieces, and on Thursdays it’s The Pulse. However, a few other things did change.

I go directly to the strongest sources for engineering deepdives. Previously, some details about tech companies and their engineering cultures came from former employees, such as in deepdives about Amazon and Facebook. But with this approach inaccuracies can slip in because some information sourced from ex-staff members may be dated.

So this year, I increasingly went directly to the most authoritative possible sources: CTOs, and current engineers, for fully accurate views of engineering cultures. With this approach, I brought you never-before-shared details about companies like Stripe, OpenAI (and ChatGPT), Meta (and its Threads team), Figma, Sourcegraph and Chronosphere.

I made a point to talk with current teams as much as possible when researching my articles, such as how Khan Academy broke up its monolith, and why Agoda decided to not move to the cloud and how that’s going. Agoda’s CTO Idan Zalzberg helpfully shared their exact hardware stack and specifications – which was a surprise, even to me!

These deepdives were well received by many readers, so I plan to keep doing them! My goal is to deliver you with more useful information in this way.

Renaming “The Scoop” as “The Pulse.” One highly visible change this year was doing away with “The Scoop” title and rebranding Thursday’s series as “The Pulse.” As I summarized in July:

The content will not change, but ‘The Pulse’ just better represents the mission of these articles, which is to help you keep an “ear to the ground” on what’s happening across Big Tech and at startups – sectors which regularly affect the whole tech industry.

I receive and validate plenty of interesting information from insiders at these companies, but my main focus is analyzing what’s going on in our industry; the implications of that, and the opportunities for software engineers and tech businesses.

Names matter, and I feel “The Scoop” suggests a more gossipy, tabloid newspaper-style approach than what these articles actually deliver.

The Pulse brings lots of exclusive insights, which I now combine with public information which other publications overlook. This is how I brought details on how much Affirm pays its employees in the US, Canada, Spain and Poland, or the pressure several commercial open source companies are facing to bring in more revenue. And of course, I still share details exclusive to The Pragmatic Engineer, like longer hiring processes for engineering managers, the quiet, heroic turnaround at Meta, and the technology choices behind Stripe’s real time Cyber Monday dashboard.

The “Industry Pulse” is a new column within The Pulse that rounds up recent events, with brief commentary. I experimented with this column in September and asked for feedback; almost all of you responded that you’d like it to stay. I also enjoy writing it, so it’s here to stay!

2. Most popular articles, and my personal favorites

Some of the most-read articles this year:

Measuring developer productivity? A response to McKinsey. The management consultancy giant expanded into offering services for measuring and improving developer productivity, selling a methodology that makes little sense to anyone who’s worked as an engineering manager or software engineer. With fellow software engineer and author Kent Beck, we offered an alternative mental model, and other helpful pointers.

Stacked Diffs (and why you should know about them) One of my biggest personal “wow” moments as a developer at Uber was when I began using stacked diffs. It’s a workflow that sounds counterintuitive, and is discussed very little outside the companies that use them, like Meta, Google, Uber, and Wikimedia. This article changed that – and stirred up quite the debate, as well! As always, I suggest experimenting with an approach if it could help solve a pain point you already have.

Inside Stripe’s Engineering Culture - Part 1. Stripe is one of the largest online payment companies and operates one of the world’s largest Ruby codebases. But there’s more to Stripe than payments and Ruby. A deepdive with Stripe CTO David Singleton.

Lessons from bootstrapped companies founded by software engineers. Bootstrapped companies are rarely discussed, but bootstrapping is the most straightforward way to start a company, as a software engineer. Five bootstrapped companies with technical founders you’ve probably not heard of.

Inside OpenAI: How does ChatGPT Ship So Quickly? OpenAI is arguably the hottest startup, globally. But the company had never discussed its software engineering practices – until this article.

My personal favorites of 2023:

Staying hands-on as an EM or tech lead. It’s increasingly tough for engineering managers or leads who are not hands-on, or technical. Practical suggestions for staying “in the loop,” even if your job doesn’t involve coding, day-to-day.

The productivity impact of AI coding tools. AI tools increase productivity, but by how much? The boost is notable, but it turns out there have been similar productivity gains in the history of computing, even when those tools were not adopted as rapidly as ChatGPT, GitHub Copilot, and others, have been.

“Wartime” vs “peacetime” at tech companies. When under pressure, many companies start to operate in a mode that’s described as “wartime.” Advice on how to recognize which mode your company is in, and how to thrive in wartime and “peacetime” environments. Plus, a look at why companies with prolonged “wartimes” (surprisingly!) rarely crumble under tech debt.

Three cloud providers, three outages: three different responses. When comparing cloud providers, it’s rarely apples-to-apples because of the different capabilities each has. Therefore, comparing how AWS, Azure and GCP responded to regional outages of their own seemed like fair game – and their responses revealed the engineering culture at each company.

Software architect archetypes. A lighthearted piece: twelve behaviors and stereotypes of experienced engineers we’ve probably all observed. Do any describe how you currently work?

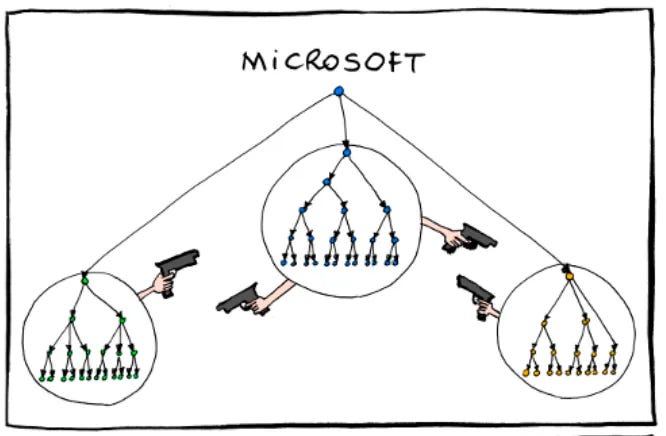

The man behind Big Tech comics. I always wondered what the story was behind the famous “Big Tech org charts” comic that resurfaces every few years. Turns out it was created by former Google and Twitter engineer Manu Cornet, one of few cartoonist/software engineers. I caught up with Manu to learn more about his career – and the backstories of his comics.

You can browse all articles, categorized, here: All Pragmatic Engineer articles.

3. New resources and templates for engineers and managers added this year

Longtime readers will be familiar with my series of resources and templates for engineering managers and software engineers. This is a living, ever-growing list to which I occasionally add new documents that might be helpful. Several more were added this year:

Measuring the impact of an engineering team

Preparing for a reorg as an EM

What is a senior engineer at Big Tech?

Code freeze approaches in 2023

AI coding tools: research data

Shopify’s engineering levels in 2023

Curbing vendor costs in 2023: details

Cloud development environment vendors in 2023

Tech compensation changes in 2023

Browse all resources here.

4. Tech industry pulse in 2023

A selection of major news stories in The Pulse during a very eventful year.

January: Big Tech layoffs

Catching most of us by surprise at the start of the year were job cuts at profitable Big Tech companies. Microsoft, Amazon, and Salesforce all announced layoffs at this time.

Most unexpected was that Google fired 12,000 employees, around 6% of staff. This layoff was historic because Google has only laid workers off twice since its founding in 1998: 300 people in 2008, and ~5,000 Motorola staff in 2013 after it acquired the phone maker. In analyzing what was at the root of this year’s layoffs, Google’s first decline in profits for many years may have been a cause.

February: aggressive performance reviews, lower bonuses, fewer middle managers, and lower vendor spending

End-of-year performance reviews in 2022 were more stringent than in previous years at places like Uber, HelloFresh, Delivery Hero, and others. Meta issued its lowest-ever performance multiplier, resulting in lower bonuses.

It was in February that we dug deeper into a trend that looked like it might be here to stay: fewer middle managers at tech companies. Insights from businesses like Meta and Sourcegraph, which cut down on these positions, seemed to chime with engineering directors-and-above finding job searches more challenging. Ten months later, this observation turned out to be on the money, unfortunately; today it feels harder than ever to get senior engineering leadership positions, as we covered only last week.

It was also in February that we dug into what looked like a dramatic slowdown in vendor spending. Tech companies seemed to be doubling down on cutting spending on cloud providers, observability and SaaS expenses. The trend of curbing seemingly wasteful spending lasted most of 2023, with access to capital and borrowing more restricted than it has been for years.

March: the collapse of Silicon Valley Bank

Silicon Valley Bank served half of all VC-funded startups in the US and UK. The financial institution was at the center of the fastest bank run in history, and collapsed more or less overnight. The US government stepped in swiftly and successfully contained a brewing crisis. The collapse – which we analyzed in-depth – was likely caused by a phenomenon that spells doom for more startups: the interest rate hikes.

April: startup funding down

The Q1 2023 startup funding data revealed all stages of startup investing were back down to 2019 levels, a major decline from 2021 and even 2022. Angel investing, early-stage and late-stage all nosedived. Exits for VC-funded companies were not as low in a decade as at this time. I speculated this was a return to 2020-and-earlier levels of investing, and a break from the outlier years of 2021 and 2022. Interestingly, this observation tracked with software engineer job listings returning to 2020 levels and earlier.

May: Datadog’s $65M/year customer revealed

Another reminder of just how crazy things were for tech companies came when I revealed Coinbase spent a whopping $65M on Datadog in 2022. This story derived from Datadog disclosing in its Q1 2023 earnings call that a major customer had churned, whereupon an analyst did the math and asked for more details about the $65M/year customer, to which Datadog replied that it was a crypto company. From there, I reached out to contacts at Coinbase to get the details.

Coinbase had such standout growth in 2022 that saving on observability costs wasn’t a focus. This year, that all changed when the company built its own observability stack to replace Datadog, but in the end, it stayed a customer at a hefty discount. This story was another confirmation of tech companies cutting vendor spend – with observability a big target area.

June: Google unexpectedly sells Google Domains

Google Domains was the world’s third most popular domain registrar, despite only being 8 years old. Ten million domains were entrusted to this product, bringing in an estimated revenue of $120M/year. And yet, Google sold the whole business to Squarespace without much explanation. Even more confusing was that a Google Cloud product – Cloud Domains – was deprecated, and its enterprise customers moved over to Squarespace, whether they liked it or not. Following the sale, I reported on domain registrars which developers recommend.

Google Domains only came out of Beta to “General Availability” a year before its sale. Eight months later, Google has not explained why this sale happened, so all we have is informed speculation suggesting that Google Domains was profitable, but likely not profitable enough. This unexpected, unexplained sale was yet another reminder why it’s hard to trust Google to support any product for more than a few years unless it contributes to the Ads business.

July: Meta’s rapid bounce back

The social media giant let go of 11% of staff in November 2022, then another 13% in April of this year. In those 6 months, one in four people at the company were laid off!

But by this July, things looked a lot better. Hiring was up, business travel slowly returned, and penny-pinching decisions like slashing the variety of snacks in offices were reversed. We covered the quiet, heroic turnaround at Meta; how engineering teams reversed the negative impact of Apple’s “App Tracking Transparency” (ATT) feature upon Meta’s ad revenue. Speaking of bouncing back: Meta’s market cap is $900B at time of publication, just 10% below the all-time high of $1.05T in September 2021.

In general, it felt that hiring rates across Big Tech started to recover from this summer onwards. My bet is that most Big Tech companies will end this year with higher overall headcounts than in early 2023, despite those January layoffs.

August: NVIDIA’s growth and StackOverflow’s decline

NVIDIA has experienced never-seen-before levels of growth, as demand exploded for generative ArtificiaI Intelligence (AI) applications and the accompanying hardware. This image speaks for itself about how much revenue has grown:

Generative AI was a massive win for NVIDIA in 2023, but not for StackOverflow. This August, there were signs that StackOverflow was seeing much less traffic and significantly fewer questions asked, compared to November 2022 – when ChatGPT was released to the public. I approached the The StackOverflow team who pushed back on the traffic decline point, but admitted to seeing significantly fewer questions and answers on the site. A few months on, it’s pretty clear ChatGPT and other AI assistants have partially replaced the Q&A site as a source of programming advice. The question still remains: what will these large language models train on, as fewer and fewer developers provide answers that can be used as training data?

September: the first tech IPOs in nearly 2 years!

Prior to September, HashiCorp was the last tech company to go public, back in December 2021. Then, for more than 18 months, there were no tech IPOs. That freeze ended with Arm, Instacart, and Klaviyo, announcing listings on public markets.

I was hopeful these three listings would break the ice and more tech IPOs would follow. But this didn’t happen, so we’ll have to wait for 2024 to see if companies like Databricks, Stripe, Reddit and others launch IPOs.

October: commercial open source struggles

In an effort to drive more revenue – and hopefully become profitable – HashiCorp changed its historically permissive open source license to the much more restrictive Business Source License (BSL.) The license change was perceived negatively within the community. I predicted that more open source software (OSS) companies will shift to more restrictive licenses like HashiCorp has.

In October, we also saw open source API debugger tool Insomnia upset users by mandating the registering of accounts to keep using the software for free. Also, the ambitious open source project, Rome Tools, founded by Sebastian McKenzie (creator of Babel JavaScript compiler) shut down only 18 months after raising a $4.5M seed round – due to not figuring out how to generate revenue before the funding ran out.

Looking ahead to 2024, open source will surely be a distribution and branding channel many VC-funded startups use. However, monetizing open source projects with permissive licenses will be challenging, so we will surely see more pivots – and some shutdowns – in this space.

November: turmoil at OpenAI

Just a few days after this publication ran the first-ever deepdive into the engineering culture at OpenAI, CEO Sam Altman was fired by the board of directors. A few turbulent days later, 95% of staff at OpenAI made it clear they were ready to quit the startup and follow Altman to become Microsoft employees. Finally, five days after his firing, Altman was restored as CEO.

This incident raised questions that remain unanswered. Why was Altman really fired? How is it that the CEO of arguably the most important AI company claims to have no ownership or equity in the company? How much influence does Microsoft really have over OpenAI? And, most importantly: is OpenAI fundamentally a nonprofit organization, or a profit-seeking, Silicon Valley business?

December: Adobe cannot buy Figma

Adobe buying Figma for a whopping $20B was the biggest story in tech acquisitions. But 15 months after it first emerged, the deal was abandoned due to regulatory concerns in the UK, EU, and possibly in future, in the US, as well.

The blocking of this deal – which we analyze in detail – no longer seems like an isolated incident. The UK regulator forced Meta to sell Giphy, and the US regulator banned California-headquartered biotech, Illumina, from acquiring another US-based challenger, Grail, for the same reason as the EU regulator was poised to block Adobe from acquiring Figma.

Looking ahead, we can expect regulators in the US and Europe to be a lot more involved in Big Tech schemes to purchase startups and scaleups. On the one hand, this will surely mean fewer cases of large tech companies acquiring startups which threaten their dominance, like Figma does Adobe’s. On the other, it will incentivize founders to build, and VCs to invest in companies with paths to becoming independent, profitable businesses which can eventually go public on their own.

Takeaways

The past 12 months in tech have been eventful, definitely not boring, and – at times – unpredictable. Like last year and 2021, it feels that progress happened much faster, and that change is much more rapid in the tech sector than anywhere else. It’s exciting to be in the industry, even though all this change makes it harder to predict what happens next!

Thanks for joining me for the ride this year. Both myself and The Pragmatic Engineer are now going on holiday for the rest of 2023. The next issue is out on 4th January 2024. I hope you enjoy some downtime and the chance to recharge. With that – happy holidays!

Thanks for such a wide range of industry topics this year, I've really enjoyed and learned from them! Enjoy the holiday break.

Hi Gergely, thank you very much for what you do. Your articles are really interesting and helpful.

Could you please update the link under “Lessons from bootstrapped companies”. It goes to “Staying Hands on as an EM”.

Merry Christmas and Happy New Year.